By Tyler Durden

By Tyler Durden

While crypto markets have historically been dominated by unregulated trading venues and retail investor activity, Goldman Sachs’ Crypto team note that 2023 has shown just how much the market structure and participation have evolved and become institutionalized.

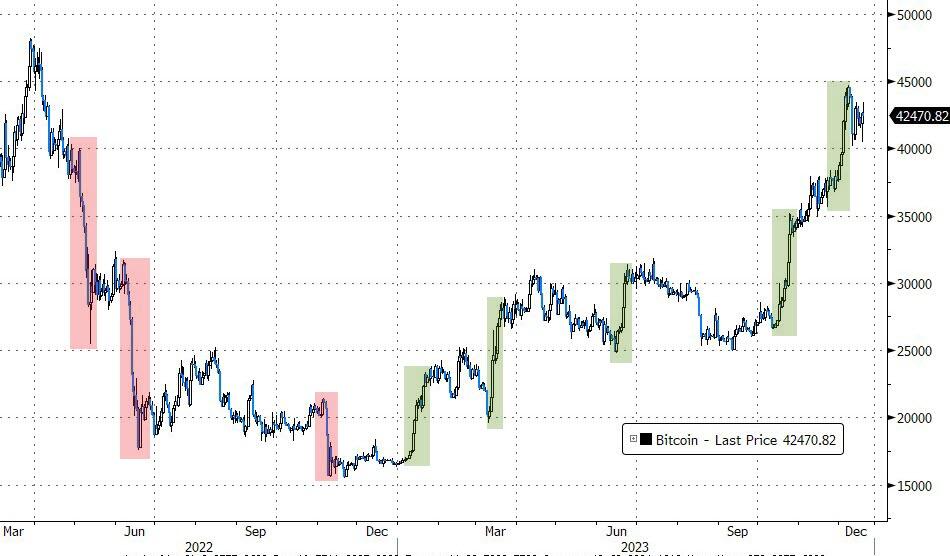

Following 2022’s “events” – including the Terra-UST depeg and a string of high-profile bankruptcies – this year, we saw a growth of regulated, centrally-cleared derivative venues including Coinbase Derivatives, Cboe, Eurex, GFO-X, AsiaNext or 24Exchange, and a recovery of those “event”-driven losses…

Source: Bloomberg

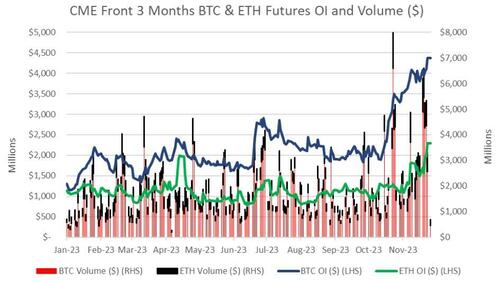

The institutionalization of the market was most evident in the derivatives market.

CME saw a consistent increase in BTC and ETH futures and options trading, and in Q4 has become the top BTC futures exchange by open interest.

While the first 9 months of the year saw BTC & ETH Open Interest flat, October price action brought along interest from institutional investors, who took the opportunity to position themselves for a potential spot BTC ETF approval and/or hedge exposure via derivatives, bringing the daily BTC OI to over $4bn…

And while we saw the interest in BTC futures in Q4 skyrocket, ETH futures trading continued to lag all through 2023, with ETH futures volumes market representing ~20-50% of BTC futures market.

Goldman adds that they have also witnessed growth across institutional-grade spot venues including EDX Markets (Citadel/Virtu), Elwood, Fusion Digital Assets (TP ICAP/Fidelity) and increased engagement across asset managers and custodians including Fidelity, BONY or BlackRock (adding that anecdotally, their client base has also shown an increased interest to face regulated entities and venues).

But while 2023 was the year of ETF anticipation, 2024 looks set to be the year that it actually occurs.

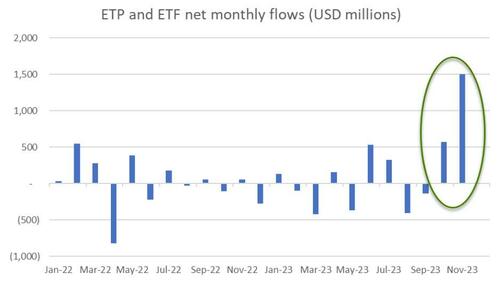

The market expectation for a potential spot BTC ETF approval was also reflected in inflows into existing ETPs & futures ETFs, especially in Q4’23, when we saw the total net inflows of $1.9bn, a stark contrast to Q2-Q3 which was characterized by lackluster investor appetite.

As the CEO of Grayscale Investments, Michael Sonnenshein, told CNBC this week, a spot Bitcoin ETF could “unlock” around “$30 trillion worth of advised wealth.”

“When we look ahead to the hopeful approval for spot Bitcoin ETFs, it really is going to unlock the opportunity to a part of the investment community that for better or worse has been locked out for the opportunity to participate in having Bitcoin exposure in their portfolio,” Sonnenshein said.

“We’re really taking about the advised market here in the US. Which is today, about $30 trillion worth of advised wealth that we hope the approval of spot Bitcoin ETFs, the up-listing of GBTC, will allow for that opportunity and for those investors to partake in it as well.“

JUST IN: 🇺🇸 Grayscale CEO tells CNBC a spot #Bitcoin ETF would "unlock" #BTC for about "$30 trillion worth of advised wealth." pic.twitter.com/yaM1riX9FI

— Bitcoin Magazine (@BitcoinMagazine) December 18, 2023

Despite the SEC pushing back its decision on several Ether ETFs to May 2024, Bloomberg’s James Seyffart notes that the last few days have seen amendments made to several Bitcoin Spot ETFs, and along with fellow Bloomberg ETF analyst Eric Balchunas, they believe the SEC could make its final approval decision as early as Jan 10th 2024.

Source: ZeroHedge

Become a Patron!

Or support us at SubscribeStar

Donate cryptocurrency HERE

Subscribe to Activist Post for truth, peace, and freedom news. Follow us on SoMee, Telegram, HIVE, Minds, MeWe, Twitter – X, Gab, and What Really Happened.

Provide, Protect and Profit from what’s coming! Get a free issue of Counter Markets today.

Be the first to comment on "2023’s Institutionalization Of Crypto Markets Set To Accelerate In 2024 As ETFs “Unlock $30 Trillion In Advised Wealth”"