Thus, our national circulating medium is now at the mercy of loan transactions of banks, which lend, not money, but promises to supply money they do not possess. — Irving Fisher

Ryan Smyth, Contributor

Activist Post

In the last part we saw how float time was fraudulently used in fractional reserve banking by banksters the same way that check kiters have used float time, and we also looked at how float time builds a temporal pyramid structure analogous to a traditional pyramid scheme. Part 4 examines how a run on the bank works, and how banks “run on the people” to cause recessions and depressions.

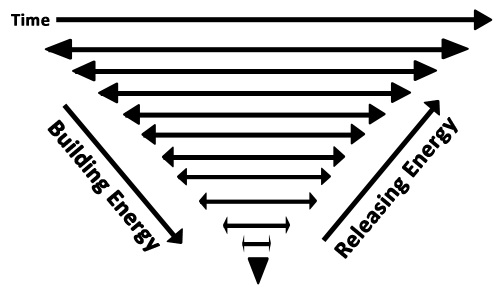

Remember back to the pyramid in float time and the mainspring metaphor. In the mainspring metaphor, fractional reserve banking gains energy through iterations the same way that a mainspring gains energy when wound. Conversely, the unwinding of a mainspring releases that energy, and the same holds for fractional reserve banking; when fractional reserve works in “reverse”, it loses energy. That can be visualized on our temporal pyramid:

In normal operation, the speed at which depositing and lending happens keeps the system more or less balanced. However, energy can be drawn off of the system in a few different ways, and if the rate that the energy builds is less than the released energy, the result is chaos, pandemonium, bedlam, dogs sleeping with cats, etc., etc.

A run on the bank happens when depositors show up en masse to withdraw their deposits. That is to say, when the people demand their money from the bank. From the Frackin’ Reserve simulator, we see something like this:

| Iteration # | Loans | Reserves | Deposits | |

|---|---|---|---|---|

| 1 | 0.00 | 100.00 | 1,000.00 | |

| 2 | 900.00 | 190.00 | 1,900.00 | |

| 3 | 1,710.00 | 271.00 | 2,710.00 | |

| 4 | 2,439.00 | 343.90 | 3,439.00 | |

| 5 | 3,095.10 | 409.51 | 4,095.10 | |

| 6 | 3,685.59 | 468.56 | 4,685.59 | |

| 7 | 4,217.03 | 521.70 | 5,217.03 | |

| 8 | 4,695.33 | 569.53 | 5,695.33 | |

| 9 | 5,125.80 | 612.58 | 6,125.80 | |

| 10 | 5,513.22 | 651.32 | 6,513.22 |

The amount of money that the bank has available at any given time is its “Reserves”. The amount that it owes to depositors is “Deposits”, and the amount of loans that it has given out is “Loans”.

Remember that this is a cycle, so Reserves + Deposits = Loans in the next row. Addition does not work across rows there.

So at iteration 10, if enough people come to the bank to ask for more than $651.32, then there is a run on the bank. But at that stage, people have deposited $6,513.22, which is far more than the meager reserves that the bank has. The system relies on people keeping 90%+ of their money in the bank. If people decide to withdraw more than 10% of their deposits, we have a run on the bank. That number is the same as the reserve requirement. i.e. 10% = 0.1 in this example.

Keep in mind that a number of European banks were just urged to raise their reserves to 8%.

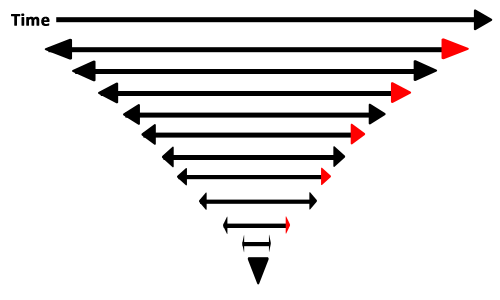

Going back to the pyramid illustration, the double-ended float time arrows alternately represent depositors and borrowers. The run on the bank happens when the borrowers withdraw their money, so highlighting the arrow-heads in red where money is withdrawn from the system looks like this:

When a run on the bank happens, typically the bank closes its doors, tells people to piss off, then goes whining to the government that they have already bought and paid for. The government in turn starts wailing about the woes of the economy, blames some BS cause, and turns around and bails out the banks with billions or trillions of dollars.

Those billions/trillions of dollars come from the people through government-issued bonds that are to be repaid through taxes, tariffs, duties, and other instruments of government theft of people’s wealth, labor and property.

A Run on the People

But that’s not the only way that the banksters steal from people. They can also induce a “run on the people”. That is to say, when the banks demand/entice money from the people. This is a two-pronged attack by the banks where they accept deposits without loaning them out, and start to call in loans.

The result is a contracted money supply. This results in recessions and depressions, unemployment, foreclosures on homes, chaos, pandemonium, bedlam, and dogs sleeping with cats.

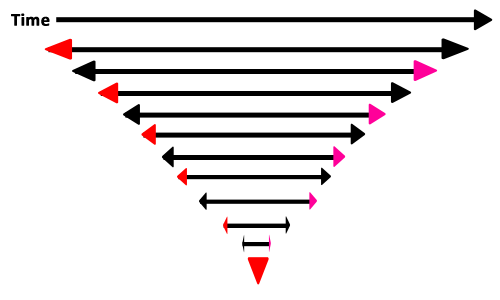

Referring back to the pyramid illustration, this is where the banksters’ attack happens:

The red arrow tips show where the bank accepts deposits with no new loans, and the hot pink arrow tips show where the bank begins calling in loans. Keep in mind that this is just a simple illustration, and while the reality is somewhat more complex, this is sufficient to illustrate the basic concept.

With a shortage of money, people are forced to sell off assets (real wealth) for less than the normal market value because the demand for money is high, while the relative supply of real wealth is high, i.e. a glut of wealth on the market, and a scarcity of money (see part 2 for “Money vs. Wealth”). The banks, who just so happen to have money, then buy up real assets for pennies on the dollar.

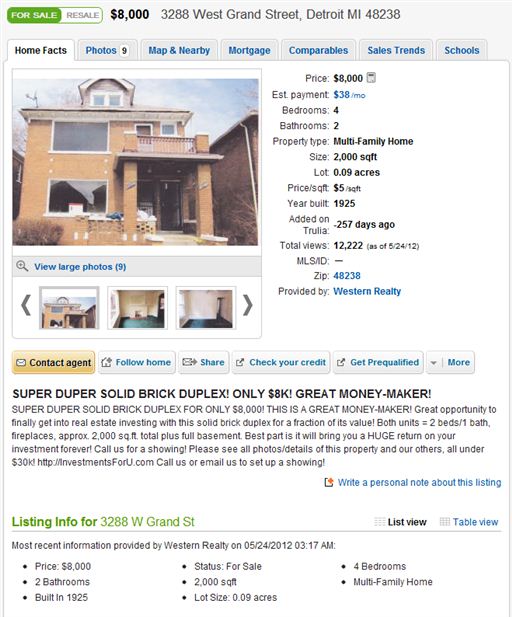

A typical example is the $500,000 home selling for $350,000. In Detroit, homes sell for less than $200 (two hundred dollars). That wasn’t a typo. With a completely random search on “detroit real estate”, my first result turns up a 4 bedroom, 2,000 sq. ft. home selling for $8,000.

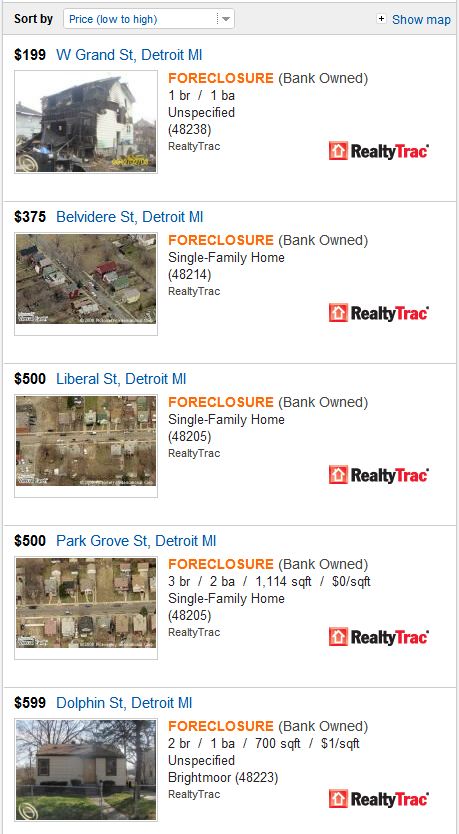

Sorting by price gives results like this (source):

While the problems in Detroit have been caused by more than just the fractional reserve banking system, the point should be clear enough. A house like the first one in other parts of the world, e.g. Melbourne, Australia, can cost between $1~2 million, while Sydney, Vancouver, and Hong Kong are all still yet more expensive.

Those are 2 ways that the banksters can launch an attack on the people, but they are also far from being the complete sum total of attacks. The banksters have many other ways as well, not the least of which is usury or interest.

So far in this series of articles we have not looked at interest or the role it plays in banking, other than a quick quote from Aristotle about how unnatural it is. Part 5 will examine usury and compound interest.

Endless money forms the sinews of war. — Marcus Tullius Cicero

Ryan Smyth is a Canadian expat currently living in Australia. He works in software, but is passionate about many current issues and the impending demise of freedom and privacy. He can be found blathering on (and sometimes ranting) at his blog, Cynic.me.

Read other articles in the Frackin’ Reserve series:

Part 1: The Mechanics of Fractional Reserve Banking

Part 2: What is Money?

Part 3: How Fractional Reserve Banking Creates Money, and Why It is Fraudulent

You can help support this information by voting on Reddit HERE

linkwithin_text=’Related Articles:’

Be the first to comment on "Frackin’ Reserve – Run on the Banks? Or Run on the People? (4/6)"