When plunder becomes a way of life for a group of men living together in society, they create for themselves in the course of time a legal system that authorizes it and a moral code that glorifies it. — Frederic Bastiat

|

| Dees Illustration |

Ryan Smyth, Contributor

Activist Post

In Part 1 we looked at the mechanics of fractional reserve banking and the mathematics behind it. We also saw how absurd it could be when trying to divide by zero. Then in Part 2 we looked at one perspective of “what is money?” and defined it in terms of its relationship to wealth.

It is now time to turn our attention to discovering “how” fractional reserve banking creates money. Once we understand the “how”, we can answer the question, “Why is fractional reserve banking fraudulent?”

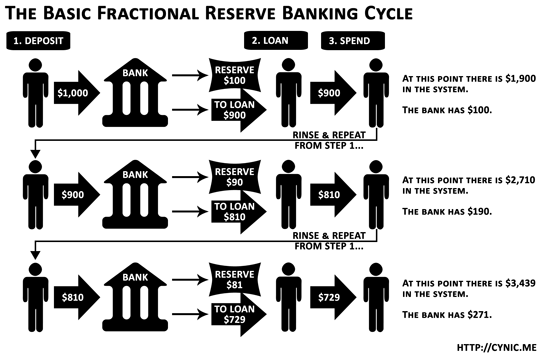

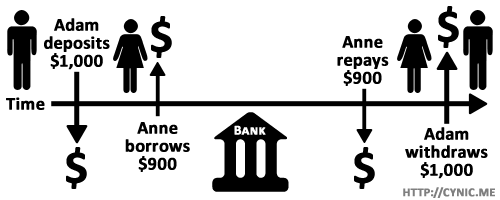

If you recall the basic fractional reserve banking cycle, it went like this:

Putting that in a table, we can see that the total amount of money that people have very quickly grows from an initial deposit of $1,000 to much, much more.

| Depositor | Deposited | Loans | Deposits | Borrower |

|---|---|---|---|---|

| 1. Adam | 1,000.00 | 0.00 | 1,000.00 | Anne |

| 2. Brian | 900.00 | 900.00 | 1,900.00 | Brenda |

| 3. Chris | 810.00 | 1,710.00 | 2,710.00 | Cathy |

| 4. David | 729.00 | 2,439.00 | 3,439.00 | Dale |

| 5. Earl | 656.10 | 3,095.10 | 4,095.10 | Edna |

| 6. Frank | 590.49 | 3,685.59 | 4,685.59 | Francine |

| 7. George | 531.44 | 4,217.03 | 5,217.03 | Gwen |

| 8. Harry | 478.30 | 4,695.33 | 5,695.33 | Helen |

| 9. Ian | 430.47 | 5,125.80 | 6,125.80 | Iona |

| 10. Jeff | 387.42 | 5,513.22 | 6,513.22 | Jennifer |

By the 35th iteration, the system has reached about 97% of its limit. But where does it come from? We understand the mathematics, but the mathematics are merely a model for what’s actually going on.

To understand where the money appears, we need to walk through the cycle again. The most important thing to be aware of is the timeline of events.

Adam deposits $1,000. Now, the bank owes Adam $1,000. And the bank, by law, can give out $900 of Adam’s money to Anne. And that is it right there. That is how fractional reserve banking manufactures money in the form of debt. That is, it creates money as debt.

When you or I write a check there must be sufficient funds in our account to cover that check, but when the Federal Reserve writes a check, it is creating money. — Boston Federal Reserve Bank

Fraudulent Abuse of Money

Looking at this from a slightly different angle, Adam gave the bank his money for safe keeping. But, instead of keeping Adam’s money safe, the bank used it. Where the bank was entrusted to protect the money, they abused it.

Looking at this from a slightly different angle, Adam gave the bank his money for safe keeping. But, instead of keeping Adam’s money safe, the bank used it. Where the bank was entrusted to protect the money, they abused it.

When you give your children to the babysitter to watch over and protect them while you go out for a quiet dinner, you don’t expect the babysitter to rape and abuse your children. This is what banksters do. They rape your money.

This is the first way in which fractional reserve banking is a crime. It is a fraudulent abuse.

The Mainspring Metaphor

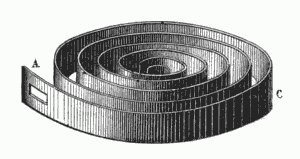

So we’ve seen how as iterations are added into the fractional reserve cycle, the money supply expands as debt.

The behaviour here is very much like a mainspring, that with each twist becomes tighter and tighter, gaining energy. Hold the spring in your hand and release it, and you’ll likely hurt yourself as it very quickly expends its stored energy. In fractional reserve banking, the cycle of a deposit and loan adds to the energy in the system.

The key concepts to understand here are the energy, and most importantly, the time involved. A slowly unwinding spring won’t rip open your hand. The spring needs to whip open, lightning fast to make you scream in pain as you run for a bandage and drip blood all over the floor. Similarly, when the fractional reserve process quickly “unwinds”, pain follows. Without understanding how time affects fractional reserve banking is to miss a great deal of what it is and what it implies.

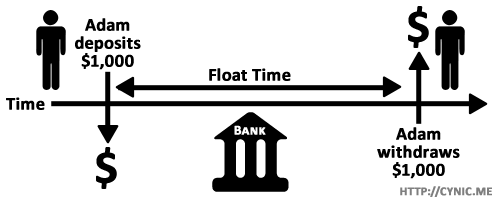

Float Time

When the bank loans that $900 to Anne, that money “has never, does not, and will never exist”. It is a fiction. Complete fantasy. Imaginary. Here’s how that works….

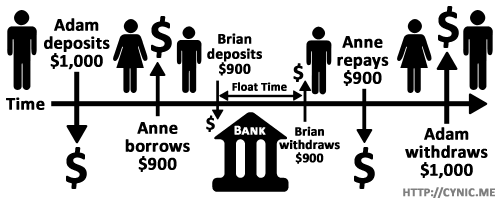

There is a time gap between when Adam deposits his money, and the time Adam withdraws his money. This is called the “float time“. Here’s what it looks like on a timeline:

It is during this period that the bank must loan out $900 of Adam’s money, and receive back that $900 from the borrower. Here’s what happens when Anne comes along to borrow that $900:

Since Anne has borrowed money, she must repay it before Adam can get his money back.

But, Anne buys a guitar for $900 from Brian, who deposits his new $900. Here’s what that looks like:

The process continues on and on, with the amounts of money becoming smaller as defined by the reserve requirement. However….

Notice how the float time keeps getting smaller. If we represent the float times from many iterations, those float times would look like this:

Can we say, “pyramid scheme”?

Fractional Reserve Banking is a Pyramid Scheme

Yes. Fractional reserve banking is a temporal pyramid scheme. (The same basic structure as a Ponzi scheme.) Temporally, it is fraud. It is fraudulent because the banks are lending out money that does not belong to them. When you deposit your money in a bank, you fully expect to be able to withdraw the full amount at any time. You do not expect to wait.

However, this is exactly what happens when there is a “run on the banks”. En masse, people withdraw their money, but the bank doesn’t have it because they have given that money away to someone else in the form of a loan. Banks then shut their doors and refuse to return people’s money to them.

A run on the bank is exactly the same thing that happens in a pyramid scheme when the bottom falls out. The entire system collapses. They are not different in any significant way. Pyramid schemes collapse because there aren’t enough people left to buy into the con; and fractional reserve banking collapses through a run on the banks because there isn’t enough time to manage the con.

A run on the bank is exactly the same thing that happens in a pyramid scheme when the bottom falls out. The entire system collapses. They are not different in any significant way. Pyramid schemes collapse because there aren’t enough people left to buy into the con; and fractional reserve banking collapses through a run on the banks because there isn’t enough time to manage the con.

This is the second way in which fractional reserve banking is criminal fraud.

Fractional Reserve Banking vs. Check Kiting

When money is created as debt, the process of fractional reserve banking very closely resembles check kiting, where the “float time” in check kiting is analogous to the time between a customer depositing and withdrawing money.

Indeed, all fractionally reserve created debt money can be viewed as “float” money. Floated money is simply money that is duplicated in the system between the time it takes for it to be deducted from one account and deposited in another account.

In the first iteration in the Frackin’ Reserve! examples above, the time between Adam depositing and withdrawing his initial $1,000 is the “float time“. During the float time, the bank takes advantage and loans out $900 of Adam’s money. This is not significantly different than the way in which a check kiter writes a check to take advantage of the float time. The kiter’s check is exactly equivalent to a bank loan, i.e. it is “debt”.

In both situations, the bank and kiter are taking advantage of the float time in order to “create” money. This is “how” fractional reserve banking fraudulently counterfeits money.

Commercial banks create checkbook money whenever they grant a loan, simply by adding new deposit dollars in accounts on their books in exchange for a borrower’s IOU. — Federal Reserve Bank of New York

Ryan Smyth is a Canadian expat currently living in Australia. He works in software, but is passionate about many current issues and the impending demise of freedom and privacy. He can be found blathering on (and sometimes ranting) at his blog, Cynic.me.

Read other articles in this series:

Part 1: The Mechanics of Fractional Reserve Banking

Part 2: Frackin’ Reserve – What is Money?

You can help support this information by voting on Reddit HERE

If you haven’t already, download the Frackin’ Reserve! simulator program, visit the web edition page, or click here for a pop-up with the web edition.

var linkwithin_site_id = 557381;

linkwithin_text=’Related Articles:’

So what if it is “fraudulent”??

Debt financing is perfectly ok as long as the GDP to debt ratio is kept in check — holding down inflation — this is the basis of monetary policy in the modern world. The brilliance in this innovation is that economic growth is no longer fixed to how well a scarce resource, gold, can be put to productive uses.

The entire point of the money supply is to get employment levels and inflation to targets that are in the long term best interest of the people…