James Coney and Liz Phillips

Daily Mail

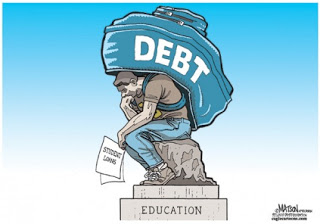

Graduates on modest incomes face an effective tax rate of 45 per cent and crippling debts for most of their working lives, a Money Mail investigation has discovered.

Radical reforms to the level of tuition fees and the way loans are repaid will leave many in debt until their mid-50s – by which time they’ll be wrestling with putting their own children through university.

Tuition fees are set to rise to as much as £9,000 a year while living costs can be up to £8,210 a year, according to the NatWest Student Living Survey.

That’s £17,210 a year or £51,630 over three years. The maximum government loan is likely to be £43,500.

RELATED ARTICLE:

4 Reasons to Change the Way We View Education

Be the first to comment on "Revealed: Crippling 30-year graduate debt trap will see parents paying instalments as their children go to university"