Jeff Berwick

Jeff Berwick

Activist Post

Precious metals headlines have spiced up in recent weeks as continuing evidence of the reverberations of The End Of The Monetary System As We Know It (TEOTMSAWKI).

The closing of the London Silver Fix, gold manipulation lawsuits in New York, Austria wanting to audit its gold held by England, Barclays being fined over gold manipulation, and China wanting more of a say over the gold price are all indicative of the coming US dollar and fiat currency collapse.

LONDON SILVER FIX ENDS, CME GROUP LOOKS INTO DAILY PRICE LIMITS ON GOLD & SILVER

An announcement on May 14 that The London Silver Fix would, after August 14, 2014, no longer operate came as a great surprise to followers of the gold and silver market.

The fix began in the late 19th century as a small group of London bullion dealers met daily to set the price for silver. After 117 years of operation, the silver fix will be no more. As FT reports, “the global benchmark for the metal – is on its deathbed.”

As if leading up to the end of the silver fix, news on April 29 that US futures exchange CME Group Inc would look into daily limits on price moves in gold and silver cited high-speed frequency traders rigging markets via dark pools and off-book exchange trading as the source of wild price fluctuations in the metals market.

Wild price movement had, after all, recently led the exchange to introduce circuit breakers in order to prevent cascading stop orders that could make price movements larger.

GOLD MANIPULATION LAWSUITS MOVE FORWARD IN NEW YORK

In its May 5 article “Banks Sued On Claims Of Fixing Price Of Gold” The New York Times covered the many gold price suppression cases looking to be heard in New York.

In a recent 40-minute hearing, lawyers for more than twenty plaintiffs gathered in Federal District Court in Manhattan to coordinate their lawsuits against five banks which make up the London Gold Fix. The suits were filed by hedge funds, private citizens and public investors like the Alaska Electrical Pension Fund, who contend that banks have used their privileged positions as market makers to rig the gold price.

The lawsuits throw into question the integrity of the gold fix which has been in existence since 1919. As The New York Times writes, “a handful of bankers began to meet in the wood-paneled offices of N. M. Rothschild & Sons in London. The purpose of the fix is to set a benchmark price for gold, which is subsequently used by dealers, central banks and mining firms to buy and sell the precious metal and its various derivatives.”

In related news, Deutsche Bank left the gold fix May 13. It will remain a defendant in the consolidated cases.

BARCLAYS FINED OVER MANIPULATION BY UK AUTHORITIES

Barclay’s was fined $43.8 million last week for failures of internal controls which allowed a trader to manipulate the setting of gold prices. This fine came but one day after Barclays was fined for rigging Libor interest rates in 2012.

The Financial Conduct Authority said on Friday there were, from 2004 until 2013, failings at Barclays in terms of preventing the manipulation of gold.

The Financial Conduct Authority said on Friday there were, from 2004 until 2013, failings at Barclays in terms of preventing the manipulation of gold.

Regulators in many countries have noted the gold fix and its lack of regulation, particularly in Britain and Germany. The Financial Conduct Authority of Britain looked at other benchmark rates, like gold and silver, per the investigation of Libor. The Federal Financial Supervisory Authority of Germany, or BaFin, is looking at the trading of precious metals as part of an inquiry into precious metals manipulation.

AUSTRIA WANTS TO AUDIT ITS GOLD IN LONDON

In addition to the price manipulation scandals, Austria announced this week that it wanted to make sure the Bank of England still has its gold. Austria will send a group of auditors to the Bank of England, where it keeps 150 tonnes of its gold worth more than $6.2 billion. According to Goldreporter.de only 17% of Austria’s 280 tonnes of gold reserves are held inside its own borders.

Apparently under public pressure, the Austrian accountability office has been forced to make the decision to send the delegation to verify the bullion held in London vaults.

“I acknowledge the request. Any grocery store is obliged to do inventory once a year. It is the only way of getting rid of these unreasonable allegations,” said Ewald Nowotny, Governor of the National Bank of Austria.

WITH WESTERN MARKETS IN DISARRAY, THE GOLD INDUSTRY MOVES EAST

With Western markets chock-full of corruption, manipulation and inefficiency, Eastern markets are looking to profit … especially in the gold sector.

China is approaching foreign banks and gold producers seeking participants in a global gold exchange in Shanghai, according to people familiar with the matter. China, the world’s top producer and importer of the metal, is seeking greater influence over pricing.

State-bank SGE, the world’s biggest physical gold exchange, has asked bullion banks like HSBC (HSBA.L), Australia and New Zealand Banking Group (ANZ.AZ), Standard Bank (SBKJ.J), Standard Chartered (STAN.L) and Bank of Nova Scotia (BNS.TO) to take part in the global trading platform. SGE could also open up an international platform for foreign brokerages and gold producers, according to sources.

“China wants to have more voice in gold prices,” said Jiang Shu, an analyst with Industrial Bank, one of the just 12 banks allowed to import gold into China. “The international exchange is the first step towards gaining a say in gold pricing.”

DUBAI: A FUTURE GOLD CENTER?

In the East, it is not only China looking to play a larger role in the gold market as the West’s influence seems to fade.

In Dubai’s desert, construction on what will one day soon be one of the world’s largest gold refineries is underway. When the refinery is completed, some expect it to help shift the balance of power in the gold industry from West to East.

In Dubai’s desert, construction on what will one day soon be one of the world’s largest gold refineries is underway. When the refinery is completed, some expect it to help shift the balance of power in the gold industry from West to East.

The $60 million refinery being built by Kaloti Precious Metals in Dubai is part of efforts to change the pattern of Western domination of the gold market. It parallels plans by the Dubai Gold and Commodities Exchange to open a spot gold contract this coming June.

“Dubai is already a top global center for gold trading,” Tarek El-Mdaka, chief executive of Kaloti Precious Metals, said in an interview. “The refinery is part of the next stage, making Dubai a top centre for physical gold refining and clearing.”

Dubai gold imports and exports increased to $75 billion in 2014 from $6 billion in 2003. 40% of the world’s physical gold trade passed through Dubai in 2013. Demand in Asia is expected to grow, and China is already buying 40% of the world’s freshly mined gold.

It won’t be too easy for Kaloti, however, as London has historically been the authority which accredits gold refineries across the globe. The London Bullion Market Association runs a Good Delivery List of certified refineries, and many refineries outside of Europe believe this system has historically favored Western firms.

“London needs to be more flexible and recognise the trend,” said Kaloti, whose company also plans to open a gold refinery with an initial annual capacity of 50-75 tonnes in Surinam this August, to tap into business in that region.

NO GOLD LEFT BEHIND

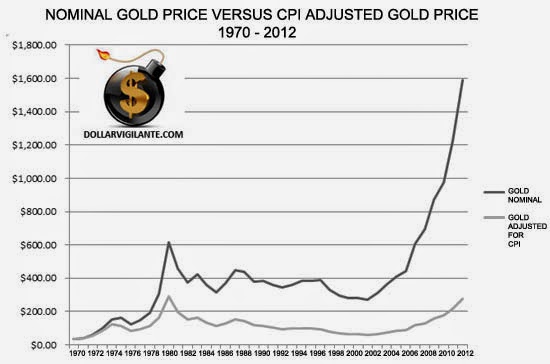

All of the aforementioned factors should lead to the continuation of what’s really a multi-decade trend of higher gold and precious metals prices (although note in the chart below that in nominal terms that while gold has risen dramatically since 2000 it really hasn’t risen tremendously when adjusted for inflation and is still early in its advance).

In anticipation of this, the gold market is packing up its bags and moving east. The conditions in the West are simply too risky. Weighed down by corruption and fraud, the Western banking system has lost the respect of its peers, who are looking to capitalize on the quagmire taking place in the US and Europe, the historical centers of the gold trade. As well, the economic power is shifting to the East now, as the West – now a hotbed of fascism/socialism/communism – falters as the East moves more towards capitalism.

One thing is clear, big changes are afoot in the precious metals market and The Dollar Vigilante (TDV) is predicting much higher gold and silver prices in the years ahead. But, it has never been more important to internationalize your precious metals as it is today with much of the West on the brink of a collapse as The End Of The Monetary System As We Know It (TEOTMSAWKI) continues. Internationalizing your precious metals isn’t easy and your government registered financial advisor likely won’t have a clue on how to do it. For that reason we created Getting Your Gold Out Of Dodge, a special report on the ins-and-outs of international gold ownership and storage.

You can also gain access to the special report by subscribing to the TDV Newsletter, a weekly publication that covers all aspects of TEOTMSAWKI including precious metals, bitcoin, internationalization and expatriation.

Have any insights? Share them with Jeff and The Dollar Vigilante Team in the comments section.

Anarcho-Capitalist. Libertarian. Freedom fighter against mankind’s two biggest enemies, the State and the Central Banks. Jeff Berwick is the founder of The Dollar Vigilante, CEO of TDV Media & Services and host of the popular video podcast, Anarchast. Jeff is a prominent speaker at many of the world’s freedom, investment and gold conferences as well as regularly in the media including CNBC, CNN and Fox Business.

Be the first to comment on "Rumblings in Precious Metals Markets A Sign of Coming Monetary System Collapse"