Gary Gibson

Activist Post

It’s odd, but Americans get happier when the roofs over their heads get harder to afford. Over the past hundred years or so, Americans have come to see houses not just as another commodity which should be getting cheaper over time thanks to market forces, but as a government-aided “investment” that makes them better off by getting more expensive!

But the unadulterated truth is that housing is just another basic appliance, like a washing machine or a car, but more essential. Society grows richer when the market’s efficiencies makes appliances more affordable, not when government intervention makes them harder to afford.

Here is a brief list of things that make our life better when they become cheaper relative to incomes:

- Gas

- Electricity

- Clothing

- Designer clothing

- Shoes

- Healthy groceries

- Gourmet food

- Restaurant meals

- Cars

- Luxury cars

- Cell phones

- Smart phones

- Desktops

- Laptops

- Information

Housing belongs on this list, too. Yet only one in a hundred million people understands that. That’s because government has had a decades-long indoctrination program that has taught its citizens to look at homes for personal use as “investments” instead of a consumption. And as with “education”, government has been artificially inflating the cost of housing in a mix of propaganda and easy lending policies.

This is how most of the world thinks: “My electricity bill is half what it used to be…my groceries cost about 1/3 less…I paid half as much for a better smartphone this year and I get twice as much data and call time for the same price as I did in my last contract…and my rent/mortgage is twice as much as it was ten years ago…Hooray!”

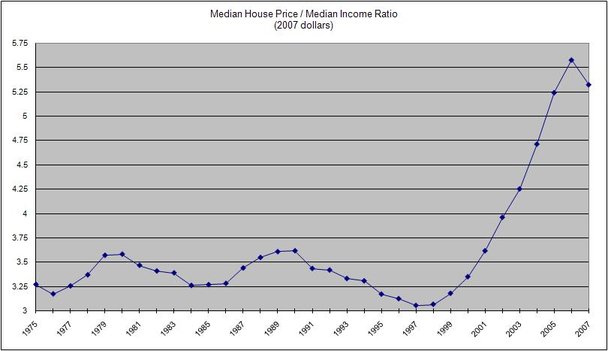

A basic necessity becoming less affordable

We are at the point where the population actually gets depressed when their mortgages and rents fall. Their economic sense is so debased that they see more affordable housing as a sign of economic contraction. That’s because the government has gotten the general population on the bandwagon of debt-based proxy ownership.

Understand that there are government departments set up specifically to facilitate increasing housing and schooling prices through the debt: Fanny Mae, Freddy Mac and Sally Mae. The Federal Reserve government-created cartel is designed to make general prices go up via money supply inflation, but those three agencies make sure that housing and schooling (not the same thing as education) prices rise faster than just about everything else.

Home “owners” are actually renters: primarily from the municipality which collects rent in the form of real estate taxes forever and also from the banks who collect rent in the form of interest for decades. In other words — and despite the propaganda you’ve heard — housing is NOT an investment. It is a consumption item, just like food or a car or oil.

Housing is an only an investment if you don’t consume it yourself but instead rent out its use at a profit. We all can easily see this with cars which we understand as things that we use up and which lose value over time. Cars are only investments if you rent and lease them out at a profit. So if you’re Budget Rent-a-Car or Kia Motors, cars are an investment. If you’re you, using the cars you rent, lease or own, then cars are consumption. And so it is with the real estate you occupy.

Housing is an only an investment if you don’t consume it yourself but instead rent out its use at a profit. We all can easily see this with cars which we understand as things that we use up and which lose value over time. Cars are only investments if you rent and lease them out at a profit. So if you’re Budget Rent-a-Car or Kia Motors, cars are an investment. If you’re you, using the cars you rent, lease or own, then cars are consumption. And so it is with the real estate you occupy.

The car market, however, doesn’t have its version of Fanny, Freddy or Sally (yet). Free of government shenanigans the housing market (and schooling market) would actually resemble the car market (in a totally free market, all markets would resemble the electronics market with everything getting more affordable over time against a stable currency). That is to say, a fairly large percentage of the population would be able to buy their houses outright while another fairly large percentage would be able to put down 0 to 50% and pay the rest off within 5 to 15 years.

How can I make such a claim? Because prior to the past century of government distortions via loan price-fixing and guarantees, that’s exactly how the housing market worked. The 2011 article “American Dream, Downsized” summed it up well:

“We’ve gone through 50 years of homeownership being the American Dream, and in those 50 years, homes didn’t do anything but appreciate,” said Bill Miley of real estate research firm Metrostudy.

Homeownership is a long-held dream for many Americans, but a century ago, it wasn’t accessible for most. Often, the only way to buy was to pay cash or take out a pricey loan with a large down payment.

Government policy helped change that. From the beginning of the federal income tax, people have been allowed to deduct their mortgage interest. In 1938, the government established the Federal National Mortgage Association, known as Fannie Mae, to provide local banks with federal money to finance home mortgages, creating the 30-year mortgage with fixed interest and leading to more housing loans.

After World War II, the GI Bill helped veterans secure low down-payment loans with low interest rates. Suburbs sprang up, and the US homeownership rate climbed above 60 percent from 45 percent in the first half of the century.

The US had become a nation of homeowners.

Meanwhile, the government continued to encourage home buying through tax breaks and programs that push homeownership for low-income earners.

Then came the real estate boom. Credit was cheap and easy to obtain, risky products such as adjustable-rate mortgages crowded the market, and by the mid-2000s, homeownership rates had spiked to nearly 70 percent.

“If you had a pulse,” Miley said, “you could get a loan.”

Home ownership would have increased on its own without government help. That’s because the free market would have made home-building cheaper with new mass production techniques and thus driven down prices.

In a free market, house prices and rents would be getting cheaper with time and use, just like any other appliance you might buy. Unless it is drawing an income via rents (whether you rent the entire space or just part of it), a house is durable consumer good of declining value for which you should get less later on under normal conditions (minus any drastic capital investment for improvement). In the meantime it will cost you money in maintenance at the very least and some of those maintenance bills could be enormous.

Then there is the fact that “owning” your living space actually means you are on the hook for local extortion payments (real estate taxes) and years of debt, and you have a large, immovable object providing an essential function (shelter) whose equity and use can be stripped from you if the authorities decide you owe them or some plaintiff money. Let us recall the basic supposition of this newsletter: the US is on an unalterable path toward a full police state and economic conditions are only going to get worse as the government pours in more force and fraud inputs to keep the system going.

Then there is the fact that “owning” your living space actually means you are on the hook for local extortion payments (real estate taxes) and years of debt, and you have a large, immovable object providing an essential function (shelter) whose equity and use can be stripped from you if the authorities decide you owe them or some plaintiff money. Let us recall the basic supposition of this newsletter: the US is on an unalterable path toward a full police state and economic conditions are only going to get worse as the government pours in more force and fraud inputs to keep the system going.

Why, under these circumstances, would you buy into an artificially propped up market that saddles you with impressive debt while whatever equity you may build becomes illiquid, highly visible, and easily confiscated?

So, Should You Ever Buy a House?

To figure out if and when you should a house, consider things from a free market perspective, because the free market fundamentals will always eventually trump whatever shenanigans the government and central bank try to pull.

Buying a house in a free market would probably confer slight financial and emotional advantages over leasing, just like owning a car is often a better move than leasing a car. Buying could be part of a longer-term cost control strategy, i.e. get the house paid off and never have to worry about a monthly payment again (though it would be foolish to pretend that maintenance won’t require a not insignificant diversion of income every month).

Only during the bubble years were 20-somethings so strongly urged to buy their homes with borrowed money. Before that the mainstream advice urged people to consider buying a home only if they would be in that home for the long haul. The ideas of a starter home (instead of just renting till an ideal home could be afforded) and then of buying with intention of flipping were both inevitable outcomes of the warped housing market swelling with longer mortgages and more debt.

Again, correctly thinking of a house as a tool like a car instead of wrongly thinking of it as an investment goes a long way in preventing some bad decisions. But to take things further, we really have to throw out the buckets of misconception when it comes to what a house ought to cost in the first place.

Currently the median house price is over three times the median income. This is almost as ridiculous as the five to nine times valuation during the bubble years. As a very general rule of thumb, you really shouldn’t buy a house that costs more than you make in a year.

That may seem a little shocking. And many would protest that they could never find adequate housing in a safe area with that kind of guideline. But that’s the ratio to keep in mind if you don’t want to be a debt slave dependent on a bubble supported by the federal government and its pet banking cartel.

[Editor’s Endnote: This article is excerpted and condensed from an article that originally appeared in TDV Homegrown.]

Gary Gibson, The Dollar Vigilante’s Editor, cut his teeth writing for liberty and profit as the managing editor of the now-defunct Whiskey & Gunpowder financial newsletter. He now writes for and edits The Dollar Vigilante. In his capacity as managing editor of TDV’s monthly subscription letter TDV Homegrown, Gary insists on playing Russian Roulette by basing himself in the USSA heartland so he can round up information on how the TDV readers stuck in the USSA can best survive and profit in the increasingly turbulent times in the morally and financially bankrupt empire.

linkwithin_text=’Related Articles:’

Be the first to comment on "Why Would You Want HIGHER House Prices?"