|

| Dees Ilustration |

Louis James

Casey International Speculator

It’s understandable that people want to know where the precious metals market is headed next. And not just because big fluctuations can be nerve-wracking, but because it makes a big difference how you’d invest today if, for instance, you think there’s a big correction ahead (save cash to buy cheaper) or not (load up and ride the wave).

But the reality is that I don’t know. Nobody knows what will happen next.

That’s why it’s called speculation.

Further, you can be right about the trend and still get wiped out if your timing is wrong. That’s why it’s easier to say what is likely to happen than what is likely to happen next.

And that, in turn, is why we at Casey Research still have quite a bit of concern and uncertainty about a possible correction in the near term, even though the Casey Consensus is unanimous in projecting rising prices for precious metals for years to come.

Some investors are tiring of our cautioning of a “possible correction,” “waiting until you see the whites of their eyes,” and so forth. Some wish the market would stop dithering and just head north into mania territory. Or wish Casey Research to stop dithering and just start issuing lots of Buy recommendations. But other, more nervous readers seem to wish we’d just admit that the market has topped and issue a Sell on everything – time to cash in our chips and go home!

I am sympathetic, but Mr. Market doesn’t know our desires and wouldn’t care if he did. We would be doing our subscribers a grave disservice if we pretended to know which way he’ll move next, when we don’t. And anyone who claims they do know is likely a former New York bridge salesman.

This is why we’ve been steering a middle course for some time. We’re not out of the market; many of our recent picks have done spectacularly well on gold’s new nominal high. But we’re also not all in.

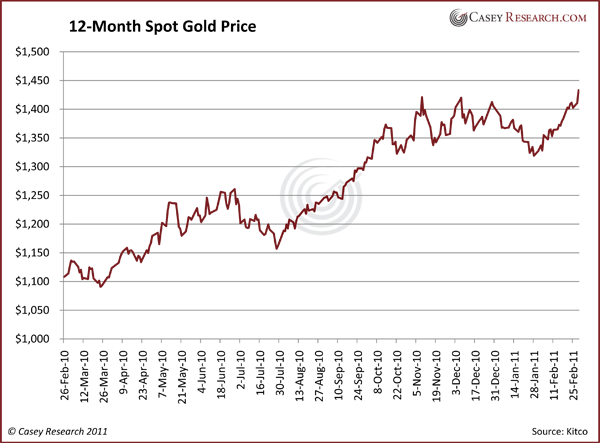

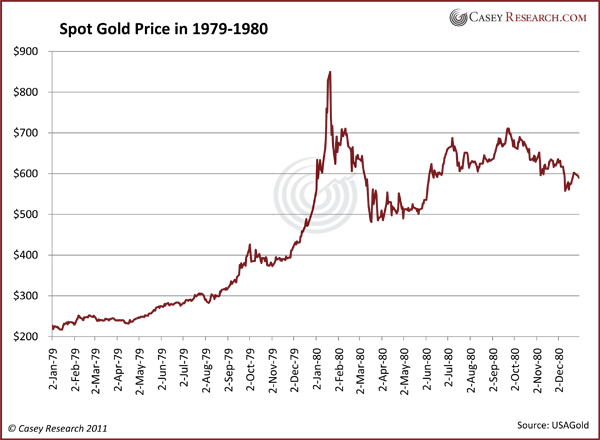

Let’s look at a simple snapshot of our most fundamental trend, the price of gold. Compare this chart of spot gold over the last year with the one below it, showing the same thing during the months before and after the 1980 spike. Does it appear to you that we’ve hit the same sort of peak? Me neither.

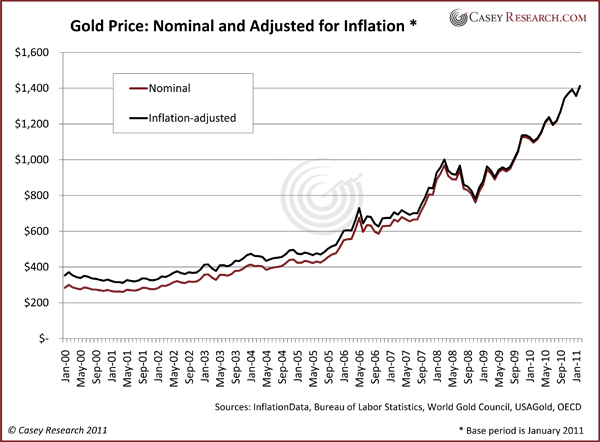

Of course, history seldom repeats, although it does rhyme. Here’s a 10-year chart of gold during the current bull market.

This chart looks a lot more like, if not a spike, at least a price peak that could now be set to slide downwards for the next 10 years.

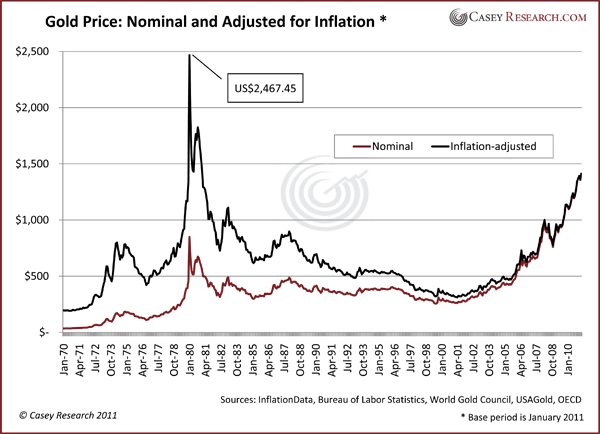

But don’t forget gold’s biggest picture, the inflation-adjusted price since it was set free by Nixon in 1971.

In nominal terms, gold certainly seems to have scaled its prior peak; in real terms, it’s still got a long way to go to beat the 1980 spike.

All of the economic and financial factors that have contributed to this precious metals bull market remain in force, and many of them have worsened. And if a big and broad market correction hits us again, the precious metals and related stocks will get squeezed, if only temporarily. The 2008 crash proved that such a squeeze can be very sharp and painful – even for groups like ours that did see it coming.

Assuming you agree with me and the Casey Consensus that this metals bull market is going to produce a gargantuan Mania Phase that lies yet ahead, I’d like you to try a mental exercise:

Ask yourself what would happen if the current sharp rise is actually rhyming with the sharp rise in the early 1970s, not the big run-up to the 1980 peak. If so, and if history continued rhyming, that’d put us before the biggest gold correction ahead of the mania.

History may not rhyme that much at all, of course, but just think about it:

- If you had bought during the 1974 peak, would you have been able to hang on through the ensuing 50% retreat to profit from the eventual mania? Would you be able to shrug off missing the lower prices available the following years and be content with your future profits based on 1974 buying?

If you answered yes, and you are certain you won’t need the cash invested for a year or two (no margin buying), then life becomes simpler for you. Buy the best of the best companies and forget about them until the Mania Phase arrives. If you are this confident – or disagree with us that another steep correction is likely in the next major economic shock – you might just work on building the best portfolio you can, for profit during the coming mania.

- Or, if you bought the 1974 top, would you kick yourself – hard – for overpaying and not having the cash to buy during the pullback?

If so, then you should take first tranches of only the best plays and keep plenty of powder dry for the time when the economy exits the eye of this most massive economic storm in modern history. Given the number of agonized vs. serene emails I got during the crash of 2008, I suspect that most investors fall into this group, so this is the context for most of our recommendations. If this rough grouping is yours, admit it, embrace it, and hedge your bets on Mr. Market’s erratic behavior accordingly.

Either way, it’s crucial for speculators to be honest with themselves about their own strengths and weaknesses. Happily, either way you still want to focus on the best of the best. The difference is in what you’re willing to pay for them, and when.

Incidentally, if we get another crash-induced bottom, I believe it will be the last before the Mania Phase kicks in – the next and last best chance to really back up the truck and position yourself for truly spectacular gains.

[Month after month, Louis James provides the market’s best investment advice in the junior mining sector… and his amazing track record has proven him right. The hand-selected, small-cap exploration stocks he recommended in 2010 outpaced the S&P 500 by 8.4 times. Find out more here.]

linkwithin_text=’Related Articles:’

Be the first to comment on "Gold Mania: Are We There Yet?"