Eric Blair

Activist Post

Yesterday, oil broke through the $100 mark for the first time since 2008 due to the populist uprising in Arab nations, indicating it’s well on its way to new heights. Many financial insiders have predicted oil will go to $150 per barrel and beyond this year. But if $100/bbl was not odd enough given the stagnant (at best) economic environment, what could possibly make it jump another 50%?

The dollar won’t drop that significantly over the next year, will it? If it does, calls to drop the petro-dollar as the reserve currency will likely turn to reality. And surely the global economy is not expected to grow fast enough to warrant a 50% jump for the lifeblood of civilization. It seems clear that demand for oil will stay relatively flat, so only a catastrophic supply problem would justify these increases.

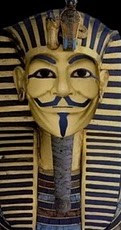

Enter the new supply problem. A stunning wave of populist protests has swept through Egypt who control the ultra-important Suez Canal. The Egyptian revolution is displaying powerful solidarity in their struggle to oust longtime autocrat Pharaoh, Hosni Mubarak, for corruption and economic suppression. And it’s beginning to look as though Mubarak will eventually be forced out and new leadership will be throned to appease the masses.

However, the uprising is expanding, and is likely to spread deeper into the psyche of the eternally oppressed around the world. The outcome of this tsunami of activism is uncertain, but stormy waves means it is surf’s up for Wall Street. The civil unrest gives them the perfect excuse to justify what can only be described as outright fraud and manipulation of the oil markets.

Bloomberg reported in 2009 that Citigroup, JP Morgan, and other “Traders” were leasing and buying oil tankers, parking them idle in the ocean, while simultaneously driving up oil futures through their brokerages. In fact, it was actually difficult to get oil when it was cheap because of this hoarding. Meanwhile, prices jumped from the low $40s to over $70 per barrel is just a few months. The near doubling of prices in the summer of 2009 caused Senator Bernie Sanders (I-VT) to introduce legislation to crack down on oil speculation.

Sanders claimed that, “Despite the record supply of oil and reduced demand, prices are going up, not down.” And that because the storage of oil in overseas tankers goes unreported to the federal government, the practice has distorted supplies and led to unnecessarily high prices. Reuters reported:

“The last thing people need now is to be ripped off at the gas pump because speculators on Wall Street — some of the same people who received the largest taxpayer bailout in U.S. history — are allowed to jack up oil prices through price manipulation and outright fraud,” he said (Sanders).

Sanders’ legislation directs the Commodity Futures Trading Commission, which oversees futures markets like the New York Mercantile Exchange, “to stop sudden or unreasonable fluctuations or unwarranted changes in prices.”

At the time, the Commissioner of the CFTC, Bart Chilton, agreed with Sanders, “I wholeheartedly agree with you that the time to act on these issues is now, and the CFTC should aggressively utilize all available authorities . . . to address these pressing issues.” Although the House overwhelmingly passed a similar bill in 2008, nothing has been done to date — except of course that the price of oil has gone up 150% since 2009 lows. Once again, the banks are benefiting from the misery of the masses.

In a recent interview, potential presidential candidate and iconic businessman Donald Trump said if the situation in Arab nations becomes catastrophic enough to break up OPEC’s control of oil, he thinks the price would go down due to more open competition. Barring that, he predicts at least $150/bbl like many other analysts. However, he was wrong to claim that OPEC sets the price of oil, as they just set output levels. Trump’s pals, the Wall Street manipulators, are who actually determines the price — and he knows that. Therefore, a break-up of OPEC is only likely to fuel further speculation.

Consequently, banks don’t care about finding a quick resolution to the chaos in the Middle East, so long as they can find a way to profit from it. Yet, you can bet that whoever ends up running these unsettled nations will likely be a shill for the establishment like Egypt’s protest leader and Globalist puppet, ElBaradei.

The situation in Egypt proves that there are forces at work far greater than governments; greater than genuine fundamentals for oil; and powerful enough to co-opt an unprecedented solidarity movement of a region — they’re called Banksters.

RECENTLY by Eric Blair:

5 Collapse-Proof Investments with Tangible Fundamentals

Google Seeks to Weaken ‘Content Farming’ Websites

Be the first to comment on "The Pharaoh will Fall, Oil will Climb, and Wall Street will Win"