Anthony Migchels

Activist Post – Contributing Writer

Most advanced political and economic debate is dominated by the Americans. Through films like Zeitgeist Addendum, The Money Masters and Money as Debt, and books like those of Thomas Greco and Ellen Brown. They have been enormously important contributions to the awakening of the many (including myself!) towards the most pressing problem of our time, our monetary “system.”

The one notable exception is interest. Of course all the aforementioned sources have dealt with interest, but to my mind there has been no really comprehensive and satisfactory analysis of interest in the Anglo Saxon world. In fact, most analysts concentrate on the fact that money is debt. There seems to be some kind of consensus that debt is the heart of the issue. But it is not. Without interest, debt would not be a problem, as I worked out here.

Interest is one of the few things that is more profoundly understood in Europe, more specifically, Germany. Throughout the 20th century interest has been analyzed by some unknown, but brilliant thinkers. Silvio Gesell comes to mind, Gottfried Feder and later Helmut Creutz and their current standard bearer Margrit Kennedy.

Feder wrote a book Breaking the Shackles of Interest, and later advised Hitler, who was to say time and again, that “the kernel of National Socialism is breaking the thralldom of interest.” Maybe that did some damage by association to the theme.

It is curious to realize, when studying Hitler, how close he came to the truth in his analysis (which was, no doubt, inspired by exactly the enemies he was purported to attack). It is mind boggling to realize how much the bankers were willing to give away and how they entrenched their supremacy by totally destroying him and his credibility.

Be that as it may, it is time to make fully clear what the scale of the interest problem is. We need to get rid of any misunderstanding, let alone underestimation of this most heinous tool in the hands of our Satanist masters.

Dealing with Interest

We’ll go through this point for point. Some points will in some way overlap others, but they are still worth mentioning because they widen our perspective. I’ll be quoting Margrit Kennedy a lot and I would strongly suggest going through her classic ‘Why we need monetary innovation’.

1. To begin with, I’ll put forward my standard example: a mortgage. Let’s say you want to buy a house and go the bank and get a loan. Say 200k. The simple truth is, after thirty years you will have payed back 600k. 200k for the principal and 400k (!!) in interest. Now this might be OK, or at least somewhat understandable, if you were borrowing this money from somebody else, who has been saving it. But as we know, this is not the case. The money is produced the moment the loan is granted by the bank. In a computer program. By pressing a few buttons.

So basically you pay 400k interest for pressing a button. Granted, the bank needs to manage the loan during the time it is being repaid. But the cost for this is still only a fraction of the income they get through the interest.

Now, we could stop here, because it is clear that the bank is ripping us off, also in legal terms, although they make the laws themselves, because there is no realistic service being delivered for the money.

But there is so much more, we must continue.

2. When the bank creates some money by giving you a loan, it takes the money out of circulation when you repay. Repaying debts means a diminishing money supply. The banks only provide the principal, in our previous example 200k. But after thirty years, 600k has been repaid and only 200k was created. So how can this be? How can 600k be repaid by 200k?

It can’t. Somebody else needs to get into debt to create sufficient liquidity to pay the 400k interest. And the borrower of the original loan must start competing for this liquidity with everybody else to obtain that, intrinsically scarce, cash.

This means that because of the combination of debt and interest, the money supply must grow forever. But we know that a growing money supply is the definition of inflation and that inflation is closely linked to rising prices. So inflation is inherent in the system. This sounds strange, because Central Banks raise interest rates to lower inflation, reasoning less credit will be issued because of rising prices for it. But the higher the interest rates go, the more money must be created to pay for this interest.

Just one of the perverse side effects of interest in the current wealth transfer system we call “finance.”

3. Due to interest, money circulates slower. This is a big problem, because the slower the money circulates, the more we need of it in circulation to meet our needs. And when you have interest bearing money as debt, that is quite a problem indeed. The reason for slower circulation is that it enhances the store of value function of money, with all its detrimental implications.

This phenomenon can be best seen when thinking about paying bills. If you know you can increase your money by postponing paying your bills, you will help the money circulate slower. People will be encouraged to hoard the money instead of spending it.

It is also more likely because of this reason rather than the growing cost of money which lessens inflation (or better, price rises) in the short term when raising interest rates. Because less money is circulating slower, demand falls.

4. Now, because of the fact that the principal is created but not the money to pay the interest, money is intrinsically scarce. Because of scarce money, capital is the scarce factor of production, whereas reason has it that labor should be the scarcer than capital. How else can we say we live in abundance?

I think it was Lietaer who pointed out the natural consequence of this state of affairs: competition. Economic actors in the current system compete with each other primarily for scarce working capital. Scarce money is a major driving force in the ever more competitive marketplace. Of course, the winners of this system have their lackeys (“economists”) explain that competition leads to efficiency. But common sense dictates that humans are more effective when they can cooperate. Surely there is a place for competition in the market, but it has gotten totally out of hand and it is getting worse.

Scarce money because of interest is one of the more profound reasons for this trend.

5. So what of it you think. I was raised to be conservative in these matters and one should simply not get into debt, so you won’t pay interest.

Wrong. Not only because if nobody went into debt, there would be no money, but because companies go into debt to finance their production. They pay interest (capital costs) over these loans. And like any cost this must be calculated into the prices they ask for their goods and services.

And what percentage of prices can be related to interest? It depends on the kind of business, particularly how capital intensive it is. Going from 12% for garbage collection to 77% for renting a house. All in all about 40% of prices can be traced back to costs for capital. These figures are by Kennedy and they have been corroborated by an independent study done by Erasmus University, Rotterdam, the Netherlands under the supervision of STRO, a leading monetary think tank in the Netherlands.

So, you lose 40% (!!!!) of your disposable income to interest through prices.

6. Interest is being payed by people borrowing money and received by people having loads of it. So it is per definition a wealth transfer from poor to rich.

It transpires, that about 80% of the poorest people pay more interest than they receive to the richest 10%. The next richest 10% pay as much as they receive. This means the vast majority is losing a substantial part of their money to interest. The richest own the banks or have a lot of money there.

We must keep in mind that this is totally for nothing, since most of the money is printed at the time it is loaned out.

How much money are we talking about? I have only figures for Germany, but reason suggests it is basically the same everywhere.

In Germany the poorest 80% pay 1 billion Euros in interest to the richest 10% PER DAY. Yes, that’s right, one billion euros per day. That is a grand total of 365 billion euro’s per year. That is one seventh of German GDP and extrapolating this to America, the poorest 80% must be paying at least a trillion a year.

It conclusively explains the old adage that the rich get richer and the poor get poorer.

This is the hidden tax that nobody is talking about.

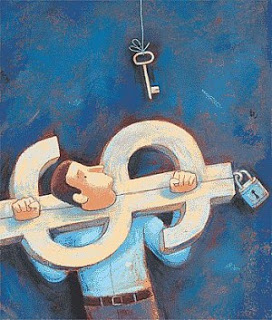

This is the yoke that we carry.

This is the worst kind of slavery, because it is slavery without even realizing it.

This is interest and let it never be forgotten.

This is our mortal enemy and let us never take our eyes of it again, until it is thrown into the fire of hell, together with the usurers enslaving us with it.

Anthony Migchels is an Interest-Free Currency activist and founder of the Gelre, the first Regional Currency in the Netherlands. You can read all of his articles on his blog Real Currencies.

RELATED ARTICLE:

The After-the-Fed Solutions Debate Begins: Greenbackers Vs. Goldbugs

Be the first to comment on "The Hidden Slavery of Interest"