It usually makes sense to follow the money when seeking understanding of almost any major change. The strategy of following the money in our current convergence of crises in late summer of 2020 leads us directly to the lockdowns. The lockdowns were first imposed on people in the Wuhan area of China. Then other populations throughout the world were told to “shelter in place,” all in the name of combating the COVID-19 virus.

Understanding of the enormous impact of the lockdowns is still developing. The lockdowns are proving to pack a far more devastating punch than any other aspect of the strange sequence of events that is making 2020 a year like no other. Even when the issues are narrowed to those of human health, the lockdowns have had, and will continue to have, far more wide-ranging and devastating impacts than the celebrity virus.

The lockdowns have, for starters, been directly responsible for explosive rates of suicide, domestic violence, overdoses, and depression. In the long run, these maladies from the lockdowns will probably kill and harm many more people than COVID-19.

But this comparison does not tell the full story. The nature and length of the lockdowns are causing millions of people to lose their jobs, businesses and financial viability. It seems that the economic descent is still gathering force. The assault of the lockdowns on our economic wellbeing still has much farther to go.

The lockdowns have proven to be a powerful instrument of social control. This attribute is becoming very attractive especially to some politicians. They have discovered they can derive considerable political traction from hyping and exploiting the largely manufactured pandemic panic.

The lockdowns are still a work-in-progress. There are past lockdowns, revolving lockdowns, partial lockdowns, mandatory lockdowns, voluntary lockdowns, severe lockdowns and probably an array of many lockdown types yet to be invented.

The lockdowns extend to disruptions in supply chains, disruptions in money flows, drops in consumption, breakdowns in transport and travelling, increased bankruptcies, losses of finance leading to losses of housing, as well as the inability to pay taxes and debts.

The lockdowns extend beyond personal habitations to prohibitions on large assemblies of people in stadiums, concert halls, churches, and a myriad of places devoted to public recreation and entertainment. On the basis of this way of looking at what is happening, it becomes clear the economic and health effects of the lockdowns are far more pronounced than the damage wrought directly by the new coronavirus.

This approach to following the money leads to the question of whether the spread of COVID-19 was set in motion as a pretext. Was COVID-19 unleashed as an expedient for bringing about the lockdowns with the goal of crashing the existing economy? What rationale could there possibly be for purposely crashing the existing economy?

One possible reason might have been to put in place new structures to create the framework for a new set of economic relationships. With these changes would come accompanying sets of altered social and political relationships.

Among the economic changes being sought are the robotization of almost everything, cashless financial interactions, and elaborate AI impositions. These AI impositions extend to digital alterations of human consciousness and behavior. The emphasis being placed on vaccines is very much interwoven with plans to extend AI into an altered matrix of human nanobiotechnology.

There are other possibilities to consider. One is that in the autumn of 2019 the economy was already starting to falter. Fortuitously for some, the new virus came along at a moment when it could be exploited as a scapegoat. By placing responsibility for the economic debacle on pathogens rather than people, Wall Street bankers and federal authorities are let off the hook. They can escape any accounting for an economic calamity that they had a hand in helping to instigate.

A presentation in August of 2019 by the Wall Street leviathan, BlackRock Financial Management, provides a telling indicator of foreknowledge. It was well understood by many insiders in 2019 that a sharp economic downturn was imminent.

At a meeting of central bankers in Jackson Hole Wyoming, BlackRock representatives delivered a strategy for dealing with the future downturn. Several months later during the spring of 2020 this strategy was adopted by both the US Treasury and the US Federal Reserve. BlackRock’s plan from August of 2019 set the basis of the federal response to the much-anticipated economic meltdown.

Much of this essay is devoted to considering the background of the controversial agencies now responding to the economic devastation created by the lockdowns. One of these agencies is empowered to bring into existence large quantities of debt-laden money.

The very public role in 2020 of the Federal Reserve of the United States resuscitates many old grievances. When the Federal Reserve was first created in 1913 it was heavily criticized as a giveaway of federal authority.

The critics lamented the giveaway to private bankers whose firms acquired ownership of all twelve of the regional banks that together constitute the Federal Reserve. Of these twelve regional banks, the Federal Reserve Bank of New York is by far the largest and most dominant especially right now.

The Federal Reserve of the United States combined forces with dozens of other privately-owned central banks throughout the world to form the Bank for International Settlements. Many of the key archetypes for this type of banking were developed in Europe and the City of London where the Rothschild banking family had a large and resilient role, one that persists until this day.

Along with the Federal Reserve Bank of New York, BlackRock was deeply involved in helping to administer the bailout in 2008. This bailout resuscitated many failing Wall Street firms together with their counterparties in a number of speculative ventures involving various forms of derivatives.

The bailouts resulted in payments of $29 trillion, much of it going to restore failing financial institutions whose excesses actually caused the giant economic crash. Where the financial sector profited greatly from the bailouts, taxpayers were abused yet again. The burden of an expanded national debt fell ultimately on taxpayers who must pay the interest on the loans for the federal bailout of the “too big to fail” financial institutions.

Unsettling precedents are set by the Wall Street club’s manipulation of the economic crash of 2007-2010 to enrich its own members so extravagantly. This prior experience bodes poorly for the intervention by the same players in this current round of responses to the economic crisis of 2020.

In preparing this essay I have enjoyed the many articles by Pam Martens and Russ Martens in Wall Street on Parade. These hundreds of well-researched articles form a significant primary source on the recent history of the Federal Reserve, including over the last few months.

In this essay I draw a contrast between the privately-owned regional banks of the Federal Reserve and the government-owned Bank of Canada that once issued low-interest loans to build infrastructure projects.

With this arrangement in place, Canada went through a major period of national growth between 1938 and 1974. Canada emerged from this period with a national debt of only $20 billion. Then in 1974 Prime Minister Pierre Trudeau dropped this arrangement to enable Canada to join the Bank of International Settlements. One result is that national debt rose to $700 billion by 2020.

We need to face the current financial crisis by developing new institutions that avoid the pitfalls of old remedies for old problems that no longer prevail. We need to make special efforts to change our approach to the problem of excessive debts and the overconcentration of wealth in fewer and fewer hands.

Locking Down the Viability of Commerce

Of all the facets of the ongoing fiasco generally associated with the coronavirus crisis, none has been so widely catastrophic as the so-called “lockdowns.” The supposed cure of the lockdowns is itself proving to be much more lethal and debilitating than COVID-19’s flu-like impact on human health.

Many questions arise from the immense economic consequences attributed to the initial effort to “flatten the curve” of the hospital treatments for COVID-19. Did the financial crisis occur as a result of the spread of the new coronavirus crisis? Or was the COVID-19 crisis set in motion to help give cover to a long-building economic meltdown that was already well underway in the autumn of 2019?

The lockdowns were first instituted in Wuhan China with the objective of slowing down the spread of the virus so that hospitals would not be overwhelmed. Were the Chinese lockdowns engineered in part to create a model to be followed in Europe, North America, Indochina and other sites of infection like India and Australia? The Chinese lockdowns in Hubei province and then in other parts of China apparently set an example influencing the decision of governments in many jurisdictions. Was this Chinese example for the rest of the world created by design to influence the nature of international responses?

The lockdowns represented a new form of response to a public health crisis. Quarantines have long been used as a means of safeguarding the public from the spread of contagious maladies. Quarantines, however, involve isolating the sick to protect the well. On the other hand the lockdowns are directed at limiting the movement and circulation of almost everyone whether or not they show symptoms of any infections.

Hence lockdowns, or, more euphemistically “sheltering in place,” led to the cancellation of many activities and to the shutdown of institutions. The results extended, for instance, to the closure of schools, sports events, theatrical presentations and business operations. In this way the lockdowns also led to the crippling of many forms of economic interaction. National economies as well as international trade and commerce were severely impacted.

The concept of lockdowns was not universally embraced and applied. For instance, the governments of Sweden and South Korea did not accept the emerging orthodoxy about enforcing compliance with all kinds of restrictions on human interactions. Alternatively, the government of Israel was an early and strident enforcer of very severe lockdown policies.

At first it seemed the lockdown succeeded magnificently in saving Israeli lives. According to Israel Shamir, in other European states the Israeli model was often brought up as an example. In due course, however, the full extent of the assault on the viability of the Israeli economy began to come into focus. Then popular resistance was aroused to reject government attempts to enforce a second wave of lockdowns against a second wave of supposed infections. As Shamir sees it, the result is that “Today Israel is a failed state with a ruined economy and unhappy citizens.”

In many countries the lockdowns began with a few crucial decisions made at the highest level of government. Large and proliferating consequences would flow from the initial determination of what activities, businesses, organizations, institutions and workers were to be designated as “essential.”

The consequences would be severe for those individuals and businesses excluded from the designation identifying what is essential. This deep intervention into the realm of free choice in market relations set a major precedent for much more intervention of a similar nature to come.

The arbitrary division of activities into essential and nonessential categories created a template to be frequently replicated and revised in the name of serving public heath. Suddenly central planning took a great leap forward. The momentum from a generation of neoliberalism was checked even as the antagonistic polarities between rich and poor continued to grow.

To be defined as “nonessential” would soon be equated with job losses and business failures across many fields of enterprise as the first wave of lockdowns outside China unfolded. Indeed, it becomes clearer every day that revolving lockdowns, restrictions and social distancing are being managed in order to help give false justification to a speciously idealized vaccine fix as the only conclusive solution to a manufactured problem.

What must it have meant for breadwinners who fed themselves and their families through wages or self-employment to be declared by government to be “non-essential”? Surely for real providers their jobs, their businesses and their earnings were essential for themselves and their dependents. All jobs and all businesses that people depend on for livelihoods, sustenance and survival are essential in their own way.

Was COVID-19 a Cover for an Anticipated or Planned Financial Crisis?

A major sign of financial distress in the US economy kicked in in mid-September of 2019 when there was a breakdown in the normal operation of the Repo Market. This repurchase market in the United States is important in maintaining liquidity in the financial system.

Those directing entities like large banks, Wall Street traders and hedge funds frequently seek large amounts of cash on a short-term basis. They obtain this cash from, for instance, money market funds by putting up securities, often Treasury Bills, as collateral. Most often the financial instruments go back, say the following night, to their original owners with interest payments attached for the use of the cash.

In mid-September the trust broke down between participants in the Repo Market. The Federal Reserve Bank of New York then entered the picture making trillions of dollars available to keep the system for short-term moving of assets going. This intervention repeated the operation that came in response to the first signs of trouble as Wall Street moved towards the stock market crash of 2008.

One of the major problems on the eve of the bailout of 2008-09, like the problem in the autumn of 2019, had to do with the overwhelming of the real economy by massive speculative activity. The problem then, like a big part of the problem now, involves the disproportionate size of the derivative bets. The making of these bets have become a dangerous addiction that continues to this day to menace the viability of the financial system headquartered on Wall Street.

By March of 2020 it was reported that the Federal Reserve Bank of New York had turned on its money spigot to create $9 trillion in new money with the goal of keeping the failing Repo Market operational. The precise destinations of that money together with the terms of its disbursement, however, remain a secret. As Pam Martens and Russ Martens write,

Since the Fed turned on its latest money spigot to Wall Street [in September of 2019], it has refused to provide the public with the dollar amounts going to any specific banks. This has denied the public the ability to know which financial institutions are in trouble. The Fed, exactly as it did in 2008, has drawn a dark curtain around troubled banks and the public’s right to know, while aiding and abetting a financial coverup of just how bad things are on Wall Street.

Looking back at the prior bailout from their temporal vantage point in January of 2020, the authors noted “During the 2007 to 2010 financial collapse on Wall Street – the worst financial crisis since the Great Depression, the Fed funnelled a total of $29 trillion in cumulative loans to Wall Street banks, their trading houses and their foreign derivative counterparties.”

The authors compared the rate of the transfer of funds from the New York Federal Reserve Bank to the Wall Street banking establishment in the 2008 crash and in the early stages of the 2020 financial debacle. The authors observed, “at this rate, [the Fed] is going to top the rate of money it threw at the 2008 crisis in no time at all.”

The view that all was well with the economy until the impact of the health crisis began to be felt in early 2020 leads away from the fact that money markets began to falter dangerously in the autumn of 2019. The problems with the Repo Market were part of a litany of indicators pointing to turbulence ahead in troubled economic waters.

For instance, the resignation in 2019 of about 1,500 prominent corporate CEOs can be seen as a suggestion that news was circulating prior to 2020 about the imminence of serious financial problems ahead. Insiders’ awareness of menacing developments threatening the workings of the global economy were probably a factor in the decision of a large number of senior executives to exit the upper echelons of the business world.

Not only did a record number of CEOs resign, but many of them sold off the bulk of their shares in the companies they were leaving.

Pam Marten and Russ Marten who follow Wall Street’s machinations on a daily basis have advanced the case that the Federal Reserve is engaged in fraud by trying to make it seem that “the banking industry came into 2020 in a healthy condition;” that it is only because of “the COVID-19 pandemic” that the financial system is” unravelling,”

The authors argue that this misrepresentation was deployed because the deceivers are apparently “desperate” to prevent Congress from conducting an investigation for the second time in twelve years on why the Fed, “had to engage in trillions of dollars of Wall Street bailouts.” In spite of the Fed’s fear of facing a Congressional investigation after the November 2020 vote, such a timely investigation of the US financial sector would well serve the public interest.

See: 177 Different Ways to Generate Extra Income

The authors present a number of signs demonstrating that “the Fed knew, or should have known…. that there was a big banking crisis brewing in August of last year. [2019]” The signs of the financial crisis in the making included negative yields on government bonds around the world as well as big drops in the Dow Jones average. The plunge in the price of stocks was led by US banks, but especially Citigroup and JP Morgan Chase.

Another significant indicator that something was deeply wrong in financial markets was a telling inversion in the value of Treasury notes with the two-year rate yielding more than the ten-year rate.

Yet another sign of serious trouble ahead involved repeated contractions in the size of the German economy. Moreover, in September of 2019 news broke that officials of JP Morgan Chase faced criminal charges for RICO-style racketeering. This scandal added to the evidence of converging problems plaguing core economic institutions as more disruptive mayhem gathered on the horizons.

Accordingly, there is ample cause to ask if there are major underlying reasons for the financial crash of 2020 other than the misnamed pandemic and the lockdowns done in its name of “flattening” its spikes of infection. At the same time, there is ample cause to recognize that the lockdowns have been a very significant factor in the depth of the economic debacle that is making 2020 a year like no other.

Some go further. They argue that the financial crash of 2020 was not only anticipated but planned and pushed forward with clear understanding of its instrumental role in the Great Reset sought by self-appointed protagonists of creative destruction. The advocates of this interpretation place significant weight on the importance of the lockdowns as an effective means of obliterating in a single act a host of old economic relationships. For instance Peter Koenig examines the “farce and diabolical agenda of a universal lockdown.”

Koenig writes, “The pandemic was needed as a pretext to halt and collapse the world economy and the underlying social fabric.”

Inflating the Numbers and Traumatizing the Public to Energize the Epidemic of Fear

There have been many pandemics in global history whose effects on human health have been much more pervasive and devastating than the current one said to be generated by a new coronavirus. In spite, however, of its comparatively mild flu-like effects on human health, at least at this point in the summer of 2020, there has never been a contagion whose spread has generated so much global publicity and hype. As in the aftermath of 9/11, this hype extends to audacious levels of media-generated panic. As with the psyop of 9/11, the media-induced panic has been expertly finessed by practitioners skilled in leveraging the currency of fear to realize a host of radical political objectives.

According to Robert E. Wright in an essay published by the American Institute for Economic Research, “closing down the U.S. economy in response to COVID-19 was probably the worst public policy in at least one-hundred years.” As Wright sees it, the decision to lock down the economy was made in ignorant disregard of the deep and devastating impact that such an action would spur. “Economic lockdowns were the fantasies of government officials so out of touch with economic and physical reality that they thought the costs would be fairly low.”

The consequences, Wright predicts, will extend across many domains including the violence done to the rule of law. The lockdowns, he writes, “turned the Constitution into a frail and worthless fabric.” Writing in late April, Wright touched on the comparisons to be made between the economic lockdowns and slavery. He write, “Slaves definitely had it worse than Americans under lockdown do, but already Americans are beginning to protest their confinement and to subtly subvert authorities, just as chattel slaves did.”

The people held captive in confined lockdown settings have had the time and often the inclination to imbibe much of the 24/7 media coverage of the misnamed pandemic. Taken together, all this media sensationalism has come to constitute one of the most concerted psychological operations ever.

The implications have been enormous for the mental health of multitudes of people. This massive alteration of attitudes and behaviours is the outcome of media experiments performed on human subjects without their informed consent. The media’s success in bringing about herd subservience to propagandistic messaging represents a huge incentive for more of the same to come. It turns out that the subject matter of public health offers virtually limitless potential for power-seeking interests and agents to meddle with the privacies, civil liberties and human rights of those they seek to manipulate, control and exploit.

The social, economic and health impacts of the dislocations flowing from the lockdowns are proving to be especially devastating on the poorest, the most deprived and the most vulnerable members of society. This impact will continue to be marked in many ways, including in increased rates of suicide, domestic violence, mental illness, addictions, homelessness, and incarceration far larger than those caused directly by COVID-19. As rates of deprivation through poverty escalate, so too will crime rates soar.

The over-the-top alarmism of the big media cabals has been well financed by the advertising revenue of the pharmaceutical industry. With some few exceptions, major media outlets pushed the public to accept the lockdowns as well as the attending losses in jobs and business activity. In seeking to push the agenda of their sponsors, the big media cartels have been especially unmindful of their journalistic responsibilities. Their tendency has been to avoid or censor forums where even expert practitioners of public health can publicly question and discuss government dictates about vital issues of public policy.

Whether in Germany or the United States or many other countries, front-line workers in this health care crisis have nevertheless gathered together with the goal of trying to correct the one-sided prejudices of of discriminatory media coverage. One of the major themes in the presentations by medical practitioners is to confront the chorus of media misrepresentations on the remedial effects of hydroxychloroquine and zinc.

On July 27 a group of doctors gathered on the grounds of the US Supreme Court to try to address the biases of the media and the blind spots of government.

Another aspect in the collateral damage engendered by COVID-19 alarmism is marked in the fatalities arising from the wholesale postponement of many necessary interventions including surgery. How many have died or will die because of the hold put on medical interventions to remedy cancer, heart conditions and many other potentially lethal ailments?

Did the unprecedented lockdowns come about as part of a preconceived plan to inflate the severity of an anticipated financial meltdown? What is to be made of the suspicious intervention of administrators to produce severely padded numbers of reported deaths in almost every jurisdiction? This kind of manipulation of statistics raised the possibility that we are witnessing a purposeful and systemic inflation of the severity of this health care crisis.

Questions about the number of cases arise because of the means of testing for the presence of a supposedly new coronavirus. The PCR system that is presently being widely used does not test for the virus but tests for the existence of antibodies produced in response to many health challenges including the common cold. This problem creates a good deal of uncertainty of what a positive test really means.

The problems with calculating case numbers extend to widespread reports that have described people who were not tested for COVID-19 but who nevertheless received notices from officials counting them as COVID-19 positive. Broadcaster Armstrong Williams addressed the phenomenon on his network of MSM media outlets in late July.

From the mass of responses he received, Williams estimated that those not tested but counted as a positive probably extends probably to hundreds of thousands of individuals. What would drive the effort to exaggerate the size of the afflicted population?

This same pattern of inflation of case numbers was reinforced by the Tricare branch of the US Defense Department’s Military Health System. This branch sent out notices to 600,000 individuals who had not been tested. The notices nevertheless informed the recipients that they had tested positive for COVID 19.

Is the inflation of COVID-19 death rates and cases numbers an expression of the zeal to justify the massive lockdowns? Were the lockdowns in China conceived as part of a scheme to help create the conditions for the public’s acceptance of a plan to remake the world’s political economy? What is to be made of the fact that those most identified with the World Economic Forum (WEF) have led the way in putting a positive spin on the reset arising from the very health crisis the WEF helped introduce and publicize in Oct. of 2019?

As Usual, the Poor Get Poorer

The original Chinese lockdowns in the winter of 2020 caused the breakdowns of import-export supply chains extending across the planet. Lockdowns in the movement of raw materials, parts, finished products, expertise, money and more shut down domestic businesses in China as well as transnational commerce in many countries outside China. The supply chain disruptions were especially severe for businesses that have dispensed with the practice of keeping on hand large inventories of parts and raw material, depending instead on just-in-time deliveries.

As the supply chains broke down domestically and internationally, many enterprises lacked the revenue to pay their expenses. Bankruptcies began to proliferate at rates that will probably continue to be astronomical for some time. All kinds of loans and liabilities were not paid out in full or at all. Many homes are being re-mortgaged or cast into real estate markets as happened during the prelude and course of the bailouts of 2007-2010.

The brunt of the financial onslaught hit small businesses especially hard. Collectively small businesses have been a big creator of jobs. They have picked up some of the slack from the rush of big businesses to downsize their number of full-time employees. Moreover, small businesses and start-ups are often the site of exceptionally agile innovations across broad spectrums of economic activity. The hard financial slam on the small business sector, therefore, is packing a heavy punch on the economic conditions of everyone.

The devastating impact of the economic meltdown on workers and small businesses in Europe and North America extends in especially lethal ways to the massive population of poor people living all over the world. Many of these poor people reside in countries where much of the paid work is irregular and informal.

At the end of April the International Labor Organization (ILO), an entity created along with the League of Nations at the end of the First World War, estimated that there would be 1.6 billion victims of the meltdown in the worldwide “informal economy.” In the first month of the crisis these workers based largely in Africa and Latin America lost 60% of their subsistence level incomes.

As ILO Director-General, Guy Ryder, has asserted,

This pandemic has laid bare in the cruellest way, the extraordinary precariousness and injustices of our world of work. It is the decimation of livelihoods in the informal economy – where six out of ten workers make a living – which has ignited the warnings from our colleagues in the World Food Programme, of the coming pandemic of hunger. It is the gaping holes in the social protection systems of even the richest countries, which have left millions in situations of deprivation. It is the failure to guarantee workplace safety that condemns nearly 3 million to die each year because of the work they do. And it is the unchecked dynamic of growing inequality which means that if, in medical terms, the virus does not discriminate between its victims in its social and economic impact, it discriminates brutally against the poorest and the powerless.

Guy Ryder remembered the optimistic rhetoric in officialdom’s responses to the economic crash of 2007-2009. He compares the expectations currently being aroused by the vaccination fixation with the many optimistic sentiments previously suggesting the imminence of remedies for grotesque levels of global inequality. Ryder reflected,

We’ve heard it before. The mantra which provided the mood music of the crash of 2008-2009 was that once the vaccine to the virus of financial excess had been developed and applied, the global economy would be safer, fairer, more sustainable. But that didn’t happen. The old normal was restored with a vengeance and those on the lower echelons of labour markets found themselves even further behind.

The internationalization of increased unemployment and poverty brought about in the name of combating the corona crisis is having the effect of further widening the polarization between rich and poor on a global scale. Ryder’s metaphor about the false promises concerning a “vaccine” to correct “financial excess” can well be seen as a precautionary comment on the flowery rhetoric currently adorning the calls for a global reset.

Wall Street and 9/11

The world economic crisis of 2020 is creating the context for large-scale repeats of some key aspects of the bailout of 2007-2010. The bailout of 2007-2008 drew, in turn, from many practices developed in the period when the explosive events of 9/11 triggered a worldwide reset of global geopolitics.

While the events of 2008 and 2020 both drew attention to the geopolitical importance of Wall Street, the terrible pummelling of New York’s financial district was the event that ushered in a new era of history, an era that has delivered us to the current financial meltdown/lockdown.

It lies well beyond the scope of this essay to go into detail about the dynamics of what really transpired on 9/11. Nevertheless, some explicit reckoning with this topic is crucial to understanding some of the essential themes addressed in this essay.

Indeed, it would be difficult to overstate the relevance of 9/11 to the background and nature of the current debacle. The execution and spinning of 9/11 were instrumental in creating the repertoire of political trickery presently being adapted in the manufacturing and exploiting of the COVID-19 hysteria. A consistent attribute of the journey from 9/11 to COVID-19 has been the amplification of executive authority through the medium of emergency measures enactments, policies and dictates.

Wall Street is a major site where much of this political trickery was concocted in planning exercises extending to many other sites of power and intrigue. In the case of 9/11, a number of prominent Wall Street firms were involved before, during and after the events of September 11. As is extremely well documented, these events have been misrepresented in ways that helped to further harness the military might of the United States to the expansionistic designs of Israel in the Middle East.

The response of the Federal Reserve to the events of 9/11 helped set in motion a basic approach to disaster management that continues to this day. Almost immediately following the pulverization of Manhattan’s most gigantic and iconographic landmarks, Federal Reserve officials made it their highest priority to inject liquidity into financial markets. Many different kinds of scenario can be advanced behind the cover of infusing liquidity into markets.

For three days in a row the Federal Reserve Bank of New York turned on its money spigots to inject transfusions of $100 billion dollars of newly generated funds into the Wall Street home of the financial system. The declared aim was to keep the flow of capital between financial institutions well lubricated. The Federal Reserve’s infusions of new money into Wall Street took many forms. New habits and appetites were thereby cultivated in ways that continue to influence the behaviour of Wall Street organizations in the financial debacle of 2020.

The revelations concerning the events of 9/11 contained a number of financial surprises. Questions immediately arose, for instance, about whether the destruction of the three World Trade Center skyscrapers had obliterated software and hardware vital to the continuing operations of computerized banking systems. Whatever problems arose along these lines, it turned out that there was sufficient digital information backed up in other locations to keep banking operations viable.

But while much digital data survived the destruction of core installations in the US financial sector, some strategic information was indeed obliterated. For instance, strategic records entailed in federal investigations into many business scandals were lost. Some of the incinerated data touched on, for instance, the machinations of the energy giant, Enron, along with its Wall Street partners, JP Morgan Chase and Citigroup.

The writings of E. P Heidner are prominent in the literature posing theories about the elimination of incriminating documentation as a result of the controlled demolitions of 9/11. What information was eliminated and what was retained in the wake of the devastation? Heidner has published a very ambitious account placing the events of 9/11 at the forefront of a deep and elaborate relationship linking George H. W. Bush to Canada’s Barrick Gold and the emergence of gold derivatives.

The surprises involving 9/11 and Wall Street included evidence concerning trading on the New York Stock Exchange. A few individuals enriched themselves significantly by purchasing a disproportionately high number of put options on shares about to fall precipitously as a result of the anticipated events of 9/11. Investigators, however, chose to ignore this evidence because it did not conform to the prevailing interpretation of who did what to whom on 9/11.

Another suspicious group of transactions conducted right before 9/11 involved some very large purchases of five-year US Treasury notes. These instruments are well known hedges when one has knowledge that a world crisis is imminent. One of these purchases was a $5 billion transaction. The US Treasury Department would have been informed about the identity of the purchaser. Nevertheless the FBI and the Securities Exchange Commission collaborated to point public attention away from these suspect transactions. (p. 199)

On the very day of 9/11 local police arrested Israeli suspects employed in the New York area as Urban Movers. The local investigators were soon pressured to ignore the evidence, however, and go along with the agenda of the White House and the media chorus during the autumn of 2001.

In the hours following the pulverization of the Twin Towers the dominant mantra was raised “Osama bin Laden and al-Qeada did it.” That mantra led in the weeks, months and years that followed to US-led invasions of several Muslim-majority countries. Some have described these military campaigns as wars for Israel.

Soon New York area jails were being filled up with random Muslims picked up for nothing more than visa violations and such. The unrelenting demonization of Muslims collectively can now be seen in retrospect as a dramatic psychological operation meant to poison minds as the pounding of the war drums grew in intensity. In the process a traumatized public were introduced to concepts like “jihad.” At no time has there ever been a credible police investigation into the question of who is responsible for the 9/11 crimes.

Defense Secretary Donald Rumsfeld chose September 10, the day before 9/11, to break the news at a press conference that $2.3 trillion had gone missing from the Pentagon’s budget. Not surprisingly the story of the missing money got buried the next day as reports of the debacle in Manhattan and Washington DC dominated MSM news coverage.

As reported by Forbes Magazine, the size of the amount said to have gone missing in Donald Rumsfeld’s 2001 report of Defense Department spending had mushroomed by 2015 to around $21 trillion. It was Mark Skidmore, an Economics Professor at the University of Michigan, who became the main sleuth responsible for identifying the gargantuan amount of federal funds that the US government can’t account for.

As the agency that created the missing tens of trillions that apparently has disappeared without a trace, wouldn’t the US Federal Reserve be in a position to render some assistance in tracking down the lost funds? Or is the Federal Reserve somehow a participant or a complicit party in the disappearance of the tens of trillions without a paper trail?

The inability or unwillingness of officialdom to explain what happened to the lost $21 trillion, an amount comparable to the size of the entire US national debt prior to the lockdowns, might be viewed in the light of the black budgets of the US Department of Defense (DOD). Black budgets are off-the-books funds devoted to secret research and to secret initiatives in applied research.

In explaining this phenomenon, former Canadian Defense Minister, Paul Hellyer, has observed, “thousands of billions of dollars have been spent on projects about which Congress and the Commander In Chief have deliberately been kept in the dark.” Eric Zuess goes further. As he explains it, the entire Defense Department operates pretty much on the basis of an unusual system well outside the standard rules of accounting applied in other federal agencies.

When news broke about the missing $21 trillion, federal authorities responded by promising that special audits would be conducted to explain the irregularities. The results of those audits, if they took place at all, were never published. The fact that the Defense of Department has developed in a kind of audit free zone has made it a natural magnet for people and interests engaged in all kinds of criminal activities.

Eric Zuess calls attention to the 1,000 military bases around the world that form a natural network conducive to the cultivation of many forms of criminal trafficking. Zuess includes in his reflections commentary on the secret installations in some American embassies but especially in the giant US Embassy in Baghdad Iraq.

The US complex in Baghdad’s Green Zone is the biggest Embassy in the world. Its monumental form on a 104 acre site expresses the expansionary dynamics of US military intervention in the Middle East and Eurasia following 9/11.

The phenomenon of missing tens of trillions calls attention to larger patterns of kleptocratic activity that forms a major subject addressed here. The shifts into new forms of organized crime in the name of “national security” began to come to light in the late 1980s. An important source of disclosures was the series of revelations that accompanied the coming apart of the Saudi-backed Bank of Credit and Commerce International, the BCCI.

The nature of this financial institution, where CIA operatives were prominent among its clients, provides a good window into the political economy of drug dealing, money laundering, weapons smuggling, regime change and many much more criminal acts that took place along the road to 9/11.

The BCCI was a key site of financial transactions that contributed to the end of the Cold War and the inception of many new kinds of conflict. These activities often involved the well-financed activities of mercenaries, proxy armies, and a heavy reliance on private contractors of many sorts.

The Enron scandal was seen to embody some of the same lapses facilitated by fraudulent accounting integral to the BCCI scandal. Given the bubble of secrecy surrounding the Federal Reserve, there are thick barriers blocking deep investigation into whether or not the US Central Bank was involved in the relationship of the US national security establishment and the BCCI.

The kind of dark transactions that the BCCI was designed to facilitate must have been channelled after its demise into other banking institutions probably with Wall Street connections. Since 9/11, however, many emergency measures have been imposed that add extra layers of secrecy protecting the perpetrators of many criminal acts from public exposure and criminal prosecutions.

The events of 9/11 have sometimes been described as the basis of a global coup. To this day there is no genuine consensus about what really transpired to create the illusion of justification for repeated US military invasions of Muslim-majority countries in the Middle East and Eurasia.

The 9/11 debacle and the emergency measures that followed presented Wall Street with an array of new opportunities for profit that came with the elaborate refurbishing and retooling of the military-industrial complex.

The response to 9/11 was expanded and generalized upon to create the basis of a war directed not at a particular enemy, but rather at an ill-defined conception identified as “terrorism.” This alteration was part of a complex of changes adding trillions to the flow of money energizing the axis of interaction linking the Pentagon and Wall Street and the abundance of new companies created to advance the geopolitical objectives emerging from the 9/11 coup.

According to Pam Martens and Russ Martens, the excesses of deregulation helped induce an anything-goes-ethos on Wall Street and at its Federal Reserve regulator in the wake of 9/11. As the authors tell it, the response to 9/11 helped set important precedents for the maintaining flows of credit and capital in financial markets.

Often the destination of the funds generated in the name of pumping liquidity into markets was not identified and reported in transactions classified as financial emergency measures. While the priority was on keeping financial pumps primed, there was much less concern for transparency and accountability among those in positions of power at the Federal Reserve.

The financial sector’s capture of the government instruments meant to regulate the behaviour of Wall Street institutions was much like the deregulation of the US pharmaceutical industry. Both episodes highlight a message that has become especially insistent as the twenty-first century unfolds.

The nature of the response to 9/11 emphasized the mercenary ascent of corporate dominance as the primary force directing governments. Throughout this transformation the message to citizens became increasingly clear. Buyer Beware. We cannot depend on governments to represent our will and interests. We cannot even count on our governments to protect citizens from corporatist attacks especially on human health and whatever financial security we have been able to build up.

Bailouts, Derivatives, and the Federal Reserve Bank of New York

The elimination of the Glass-Steagall Act in 1999 was essential to the process of dramatically cutting back the government’s role as a protector of the public interest on the financial services sector. The Glass-Steagall Act was an essential measure in US President Franklin D. Roosevelt’s New Deal. Some view the New Deal as a strategy for saving capitalism by moderating ts most sharp-edged features. Instituted in 1933 in response to the onset of the Great Depression, the Glass-Steagall Act separated the operations of deposit-accepting banks from the more speculative activity of investment brokers.

The termination of the regulatory framework put in place by the Glass Steagall Act opened much new space for all kinds of experiments in the manipulation of money in financial markets. The changes began with the merger of different sorts of financial institutions including some in the insurance field. Those overseeing the reconstituted entities headquartered on Wall Street took advantage of their widened latitudes of operation. They developed all sorts of ways of elaborating their financial services and presenting them in new packages.

The word, “derivative” is often associated with many applications of the new possibilities in the reconstituted financial services sector. The word, derivative, can be applied to many kinds of transactions involving speculative bets of various sorts. As the word suggests, a derivative is derived from a fixed asset such as currency, bonds, stocks, and commodities. Alterations in the values of fixed assets affect the value of derivatives that often take the form of contracts between two or more parties.

One of the most famous derivatives in the era of the financial crash of 2007-2010 was described as mortgaged-backed securities. On the surface these bundles of debt-burdened properties might seem easy to understand. But that would be a delusion. The value of these products was affected, for instance, by unpredictable shifts in interest rates, liar loans extended to homebuyers who lacked the capacity to make regular mortgage payments, and significant shifts in the value of real estate.

Mortgage-backed securities were just one type of a huge array of derivatives invented on the run in the heady atmosphere of secret and unregulated transactions between counterparties. Derivatives could involve contracts formalizing bets between rivals gambling on the outcome of competitive efforts to shape the future. An array of derivative bets was built around transactions often placed behind the veil of esoteric nomenclature like “collateralized debt obligations” or “credit default swaps.”

The variables in derivative bets might include competing national security agendas involving, for instance, pipeline constructions, regime change, weapons development and sales, false flag terror events, or money laundering. Since derivative bets involve confidential transactions with secret outcomes, they can be derived from all sorts of criteria. Derivative bets can, for instance, involve all manner of computerized calculations that in some cases are constructed much like war game scenarios.

The complexity of derivatives became greater when the American Insurance Group, AIG, began selling insurance programs to protect all sides in derivative bets from suffering too drastically from the consequences of being on the losing side of transactions.

The derivative frenzy, sometimes involving bets being made by parties unable to cover potential losses, overwhelmed the scale of the day-to-day economy. The “real economy” embodies exchanges of goods, services, wages and such that supply the basic necessities for human survival with some margin for recreation, travel, cultural engagement and such.

The Swiss-based Bank for International Settlements calculated in 2008 that the size of the all forms of derivative products had a monetary value of $1.14 quadrillion. A quadrillion is a thousand trillions. By comparison, the estimated value of all the real estate in the world was $75 trillion in 2008.

[Bank for International Settlements, Semiannual OTC derivative statistics at end-December, 2008.]

As the enticements of derivative betting preoccupied the leading directors of Wall Street institutions, their more traditional way of relating to one another began to falter. It was in this atmosphere that the Repo Market became problematic in December of 2007 just as it showed similar signs of breakdown in September of 2019.

In both instances the level of distrust between those in charge of financial institutions began to falter because they all had good reason to believe that their fellow bankers were overextended. All had reason to believe their counterparts were mired by too much speculative activity enabled by all sorts of novel experiments including various forms of derivative dealing.

In December of 2007 as in the autumn of 2019, the Federal Reserve Bank of New York was forced to enter the picture to keep the financial pumps on Wall Street primed. The New York Fed kept the liquidity cycles flowing by invoking its power to create new money with the interest charged to tax payers.

As the financial crisis unfolded in 2008 and 2009 the Federal Reserve, but especially the privately-owned New York Federal Reserve bank, stepped forward to bail out many financial institutions that had become insolvent or near insolvent. In the process precedents and patterns were established that are being re-enacted with some modifications in 2020.

One of the innovations that took place in 2008 was the decision by the Federal Reserve Bank of New York to hire a large Wall Street financial institution, BlackRock, to administer the bailouts. These transfers of money went through three specially created companies now being replicated as Special Purpose Vehicles in the course of the payouts of 2020.

In 2008-09 BlackRock administered the three companies named after the address of the New York Federal Reserve Bank on Maiden Lane. BlackRock emerged from an older Wall Street firm called Blackstone. Its former chair, Peter C. Peterson, was a former Chair of the Federal Reserve Bank of New York.

The original Maiden Lane company paid Bear Stearns Corp $30 billion. This amount from the New York Fed covered the debt of Bear Stearns, a condition negotiated to clear the way for the purchase of the old Wall Street institution by JP Morgan Chase. Maiden Lane II was a vehicle for payouts to companies that had purchased “mortgage-backed securities” before these derivative products turned soar.

Maiden Lane III was to pay off “multi-sector collateralized debt obligations.” Among these bailouts were payoffs to the counterparties of the insurance giant, AIG. As noted, AIG had developed an insurance product to be sold to those engaged in derivative bets. When the bottom fell out of markets, AIG lacked the means to pay off the large number of insurance claims made against it. The Federal Reserve Bank of New York stepped in to bail out the counterparties of AIG, many of them deemed to be “too big to fail.”

Among the counterparties of AIG was Goldman Sachs. It received of $13 billion from the Federal Reserve. Other bailouts to AIG’s counterparties were $12 billion to Deutsche Bank, $6.8 billion to Merrill Lynch, $5 billion to Switzerland’s UBS, $7.9 billion to Barclays, and $5.2 billion to Bank of America. Some of these banks received additional funds from other parts of the overall bailout transaction. Many dozens of other counterparties to AIG also received payouts in 2008-2009. Among them were the Bank of Montreal and Bank of Scotland.

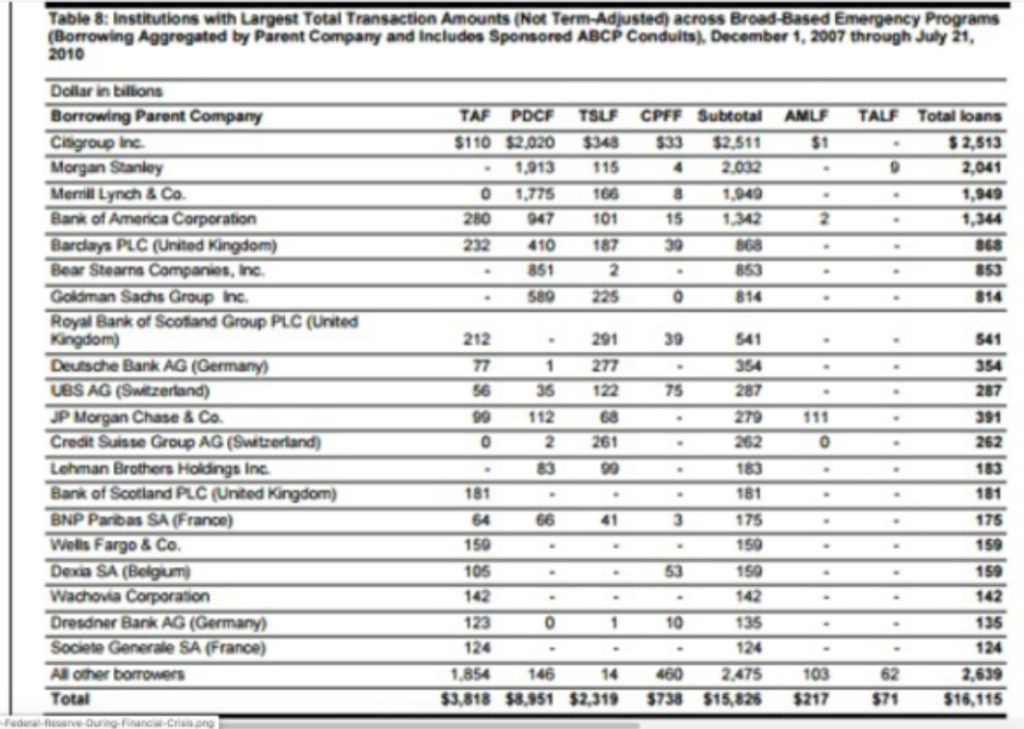

The entire amount of the bailouts was subsequently calculated to be a whopping $29 trillion with a “t.” The lion’s share of these funds went to prop up US financial institutions and the many foreign banks with which they conducted business.

Much of this money went to the firms that were shareholders in the Federal Reserve Bank of New York or partners of the big Wall Street firms. Citigroup, the recipient of the largest amount, received about $2.5 trillion in the federal bailouts. Merrill Lynch received $2 trillion,

The Federal Reserve Bank was established by Congressional statute in 1913. The Federal Reserve headquarters is situated in Washington DC. The Central Bank was composed of twelve constituent regional banks. Each one of these regional banks is owned by private banks.

The private ownership of the banks that are the proprietors of the Federal Reserve system has been highly contentious from its inception. The creation of the Federal Reserve continues to be perceived by many of its critics as an unjustifiable giveaway whereby the US government ceded to private interests its vital capacity to issue its own currency and to direct monetary policy like the setting of interest rates.

Pam Martens and Russ Martens at Wall Street on Parade explain the controversial Federal Reserve structure as follows

While the Federal Reserve Board of Governors in Washington, D.C. is deemed an “independent federal agency,” with its Chair and Governors appointed by the President and confirmed by the Senate, the 12 regional Fed banks are private corporations owned by the member banks in their region. The settled law under John L. Lewis v. the United States confirms: “Each Federal Reserve Bank is a separate corporation owned by commercial banks in its region.”

In the case of the New York Fed, which is located in the Wall Street area of Manhattan, its largest shareowners are behemoth multinational banks, including JPMorgan Chase, Citigroup, Goldman Sachs and Morgan Stanley.

There was no genuine effort after the financial debacle of 2007-2010 to correct the main structural problems and weaknesses of the Wall Street-based US financial sector. The Dodd-Frank Bill signed into law by US President Barack Obama in 2010 did make some cosmetic changes. But the main features of the regulatory capture that has taken place with the elimination of the Glass-Steagall Act remained with only minor alterations. In particular the framework was held in place for speculative excess in derivative bets.

In the summer edition of The Atlantic, Frank Partnoy outlined a gloomy assessment of the continuity leading from the events of 2007-2010 to the current situation. This current situation draws a strange contrast between the lockdown-shattered quality of the economy and the propped-up value of the stock market whose future value will in all probability prove unsustainable. Partnoy writes,

It is a distasteful fact that the present situation is so dire in part because the banks fell right back into bad behavior after the last crash–taking too many risks, hiding debt in complex instruments and off-balance-sheet entities, and generally exploiting loopholes in laws intended to rein in their greed. Sparing them for a second time this century will be that much harder.

Wall Street Criminality on Display

The frauds and felonies of the Wall Street banks have continued after the future earnings of US taxpayers returned them to solvency after 2010. The record of infamy is comparable to that of the pharmaceutical industry.

The criminal behaviour in both sectors is very relevant to the overlapping crises that are underway in both the public health and financial sectors. In 2012 the crime spree in the financial sector began with astounding revelations. . .

Click here to read the entire article on the American Herald Tribune website.

Anthony James Hall has been Editor In Chief of the American Herald Tribune since its inception. Between 1990 and 2018 Dr. Hall was Professor of Globalization Studies and Liberal Education at the University of Lethbridge where he is now Professor Emeritus. The focus of Dr. Hall’s teaching, research, and community service came to highlight the conditions of the colonization of Indigenous peoples in imperial globalization since 1492.

Originally published on www.ahtribune.com

Sourced from GreenMedInfo

Disclaimer: This article is not intended to provide medical advice, diagnosis or treatment. Views expressed here do not necessarily reflect those of GreenMedInfo or its staff.

Subscribe to Activist Post for truth, peace, and freedom news. Send resources to the front lines of peace and freedom HERE! Follow us on SoMee, HIVE, Parler, Flote, Minds, and Twitter.

Provide, Protect and Profit from what’s coming! Get a free issue of Counter Markets today.

Be the first to comment on "Lockdowns, Coronavirus, and Banks: Following the Money"