By Tyler Durden

By Tyler Durden

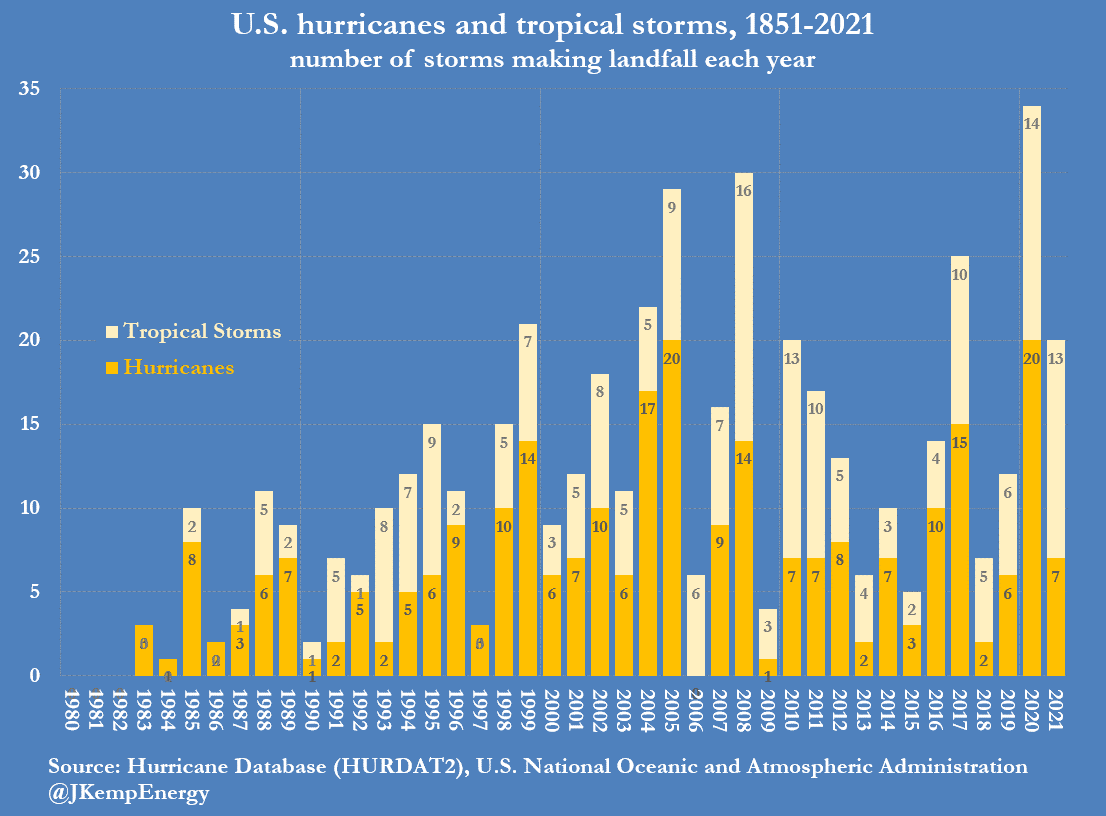

Just three weeks ago we observed how the 2022 Hurricane season had neared its halfway point without any hurricanes making landfall on the coast of the United States.

All that is about to change and with a bang: as the powerful Hurricane Ian bears down on Florida which is rapidly evacuating ahead of landfall, it threatens to further destabilize a homeowners-insurance market already teetering on the edge of disaster.

The storm is expected to make landfall along the southwest Florida coast late Wednesday or early Thursday, and could send seawater coursing through the streets of Tampa.

While Ian’s strength and trajectory are subject to change in the coming days, one early estimate pegs potential damage and economic losses in the Tampa Bay region at $50 billion to $70 billion, according Chuck Watson, a disaster modeler with Enki Research.

That price tag, according to Bloomberg citing data from the National Oceanic and Atmospheric Administration, would make Ian among the costliest storms in US history, as the top end of that range would rank Ian as the sixth-costliest US hurricane. Difficulties in getting needed material and supplies to victims due to snagged supply chains are likely to raise costs even further.

Some insurers will likely not survive: Ian is arriving in the wake of six insolvencies among insurers that write homeowner policies in the state. According to Bloomberg, the largest insurers largely pulled back from the market after taking a beating from natural disasters, and the smaller firms still active there have struggled to endure losses.

“It’s kind of the worst timing for the storm, especially if it hits Tampa Bay,” Logan McFaddin, vice president of state government relations for the American Property Casualty Insurance Association, said in an interview.

Flood damages aren’t typically covered in home policies. Instead, they fall under policies managed by the Federal Emergency Management Agency.

“If this is a major flood event, that could leave many homeowners vulnerable,” said Mark Friedlander, a spokesman for the Insurance Information Institute. “If there were major windstorm losses, other companies could be pushed in the direction of potential insolvency as well.”

State-backed Citizens Property Insurance Corp. accounts for slightly more than 10% of the Florida homeowners insurance market by premiums written. The market share is somewhat higher in some of the counties surrounding Tampa, according to Michael Peltier, a spokesman for Citizens. The insurer has been forced to take on more market share as other firms fold or cease writing policies due to rampant litigation and scams lawmakers have struggled to subdue.

Progressive has said it doesn’t want renew about 60,000 policies in the state, citing efforts to “limit growth in the coastal and hail-prone” areas while focusing on regions less prone to catastrophe losses. Florida has passed legislation that would make those exits harder; meanwhile, the company is charging more for insurance, particularly for homes with older roofs.

As part of its preparations for the storm, Citizens is setting up catastrophe-response teams and getting ready to deploy vehicles equipped to assess damage and assist customers who lose internet access.

“It’s no secret that the private market has been facing some challenging times here in Florida,” Peltier said. “Having a hurricane come ashore certainly doesn’t help.”

And then there are those insurers who will survive, only to make the US inflation problem even worse: the massive losses will likely lead insurance companies to join sovereigns such as Japan in selling some of their Treasury holdings to raise money to pay claims, which in turn will help spur inflation. This takes place amid an already strapped supply chain and high inflation. The storm appears likely to intensify food inflation as Ian takes direct aim on crucial orange-growing and fertilizer-manufacturing zones.

In short: a perfect storm in the worst possible time.

Source: ZeroHedge

Top image: Pixabay

Become a Patron!

Or support us at SubscribeStar

Donate cryptocurrency HERE

Subscribe to Activist Post for truth, peace, and freedom news. Follow us on SoMee, Telegram, HIVE, Flote, Minds, MeWe, Twitter, Gab, What Really Happened and GETTR.

Provide, Protect and Profit from what’s coming! Get a free issue of Counter Markets today.

Be the first to comment on "Hurricane Ian To Unleash Up To $70 Billion In Losses, Insurance Market Devastation And Even Bigger Spike In Inflation"