Insider Trading Info at Countrywide and Fannie Mae Led to Housing Collapse

Aaron Dykes

Activist Post

Activist Post

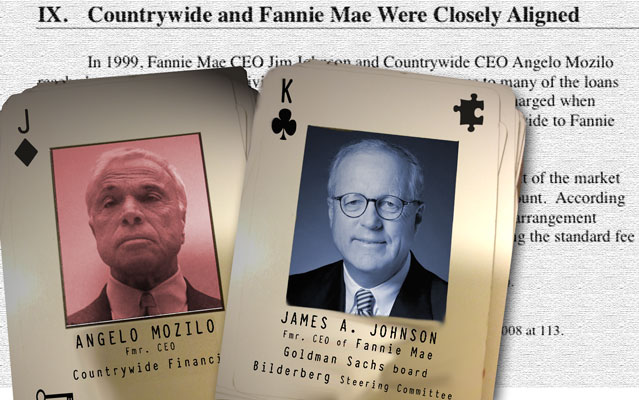

Just ahead of the housing collapse that triggered the economic collapse and jobless drift, this man, Angelo Mozilo, then CEO at Countrywide, and Bilderberg Steering Committee member James A. Johnson, then CEO of Fannie Mae, were granting Congresspeople preferential “VIP” loans – while Goldman Sachs (with James A. Johnson a board member) bet on its collapse, and of the AIG insurance backing it.

Congress investigated and found some… issues… but these (apparent) criminals go free and remain in the shadows of public knowledge.

With Johnson a Bilderberg steering committee member, multiple-presidential campaign advisor and Goldman Sachs board member, it is perhaps significant to note that at the 2006 Bilderberg Meeting in Ottawa, Canada, investigative journalist Daniel Estulin reported that sources were telling him that Bilderberg had essentially decided to pop the housing bubble and that concerns over the housing crisis would be used to further bring the economy down This was two years before the housing collapse would trigger the worst economic crisis in the United States since the Great Depression – no one could have just made this stuff up. There is the clear indication here of insider trading and racketeering – a real investigation needs to take place to point fingers and arrest the banksters committing racketeering.

Bilderberg Insiders Warn Elites Will Use Housing Crash to Bring Down Economy

Financial Products, Clip from Inside Job Documentary (2010)

Via Wikipedia:

Mozilo’s compensation during the United States housing bubble of 2001–06 later came under scrutiny. During that period, his total compensation (including salary, bonuses, options and restricted stock) approached $470 million.

Mozilo testified before the United States House Committee on Oversight and Government Reform on March 7, 2008, calling reports of their pay “grossly exaggerated” in some instances and pointing out that they lost millions as well. He defended the pay: The compensation was a function of how the company did ahead of the mortgage crisis.

(Though there is obvious corruption, no prosecutions or further investigations have taken place.)

——

http://oversight.house.gov/wp-content/uploads/2012/07/Countrywide-112th-Report-7.3.12-1207-PM.pdf

IX. Countrywide and Fannie Mae Were Closely Aligned

From the U.S. House of Representatives Committee on Oversight and Government Reform (Darrell Issa, Chairman) report from July 5, 2012, titled “How Countrywide Used its VIP Loan Program To Influence Washington Policymakers.”

In 1999, Fannie Mae CEO Jim Johnson and Countrywide CEO Angelo Mozilo reached a strategic agreement giving Fannie Mae exclusive access to many of the loans originated by Countrywide in exchange for a discount on fees Fannie charged when buying loans. The agreement linked the growth and success of Countrywide to Fannie Mae’s continued desire to acquire a large volume of loans. Fannie Mae designed the deal to lock competitor Freddie Mac out of the market for Countrywide’s loans. 218 The agreement amounted to a volume discount. According to Paul Muolo and Matthew Padilla, co – authors of Chain of Blame , the arrangement linked Fannie Mae and Countrywide “at the hip.”

E – mail from Maritza Cruz to Kay Gerfen (Sep. 19, 2002) (CW – COGR2 – 0007149). Instead of assessing the standard fee a 75 of 23 basis points (0.23 percent) for every loan it guaranteed, Fannie Mae charged Countrywide only 13 basis points, “the lowest ‘g – fee’ deal Fannie had ever granted.” 220 While negotiating the volume discount, Countrywide CEO Angelo Mozilo leveraged his company’s position as the nation’s largest residential housing lender to extract concessions from Fannie Mae CEO Jim Johnson, who himself received more than $10 million worth of Countrywide VIP loans. 221 Fannie Mae General Counsel Alfred Pollard stated that he is “not aware of a general industry practice of other purchasers of mortgages entering into similar agreements during this timeframe . . . .”

E – mail from Maritza Cruz to Kay Gerfen (Sep. 19, 2002) (CW – COGR2 – 0007149). Instead of assessing the standard fee a 75 of 23 basis points (0.23 percent) for every loan it guaranteed, Fannie Mae charged Countrywide only 13 basis points, “the lowest ‘g – fee’ deal Fannie had ever granted.” 220 While negotiating the volume discount, Countrywide CEO Angelo Mozilo leveraged his company’s position as the nation’s largest residential housing lender to extract concessions from Fannie Mae CEO Jim Johnson, who himself received more than $10 million worth of Countrywide VIP loans. 221 Fannie Mae General Counsel Alfred Pollard stated that he is “not aware of a general industry practice of other purchasers of mortgages entering into similar agreements during this timeframe . . . .”

FINDING: A strategic alliance forged in 1999 between Countrywide and Fannie Mae linked the growth of the two companies. The agreement was unique – there was not a general industry practice of giving a volume discount to a mortgage originator. In 2005, the two companies agreed to work together to expand lending to low – income borrowers. Countrywide and Fannie Mae further expanded their relationship with another strategic alliance agreement in 2005. During each quarter, Countrywide was required to sell to Fannie Mae at least 70 percent of all “Expanded Criteria Mortgages,” and at least 65 percent of those mortgages each month. Fannie Mae also agreed to “provide special marketing and other assistance” to Countrywide in its efforts to reach low – income borrowers. 224 Both parties pledged to continue a “Favored Relationship” in which they were “committed to the business success of the other party.” 225 The 2005 agreement required both companies to “maintain the complete confidentiality of the existence and terms of this agreement.”

In September 2005, Fannie Mae lobbyist Sharon Canavan wrote an e – mail to Countrywide lobbyist Pete Mills. Canavan, whose own loans were processed by Countrywide’s VIP unit, stated: “We just signed a new alliance deal with you guys. Pleasure doing business with you Mills replied: “Good. I like you guys!!!” 228 Fannie Mae Employees Gave Countrywide Inside Information Throughout 2005, Fannie Mae and Countrywide continued to expand their alliance. In April 2005, Fannie offered Countrywide “improved pricing for investor loan products,” the goal of which was “to offer an execution that is more competitive with private label execution.” 229 Days later, on April 19, 2005, a Fannie Mae official provided Countrywide executives with “a valuable heads up” on a change in loan collection policy.

David Battany, former Director of Single – Family Business in Fannie Mae’s Western Region office located in Pasadena, California, emphasized the sensitive nature of the information. In an e – mail to Countrywide Chief Risk Officer John McMurray, Battany stated: The above policy is not public, and you should be the first in the country to know this information. Please do not share this information outside of Countrywide at this time.

Fannie Mae Senior Executives Received the Highest Level of VIP Service Documents and information obtained by the Committee show the extent of Countrywide’s efforts to align the company with the most senior leadership at the GSEs. Documents show that Mozilo was personally involved in helping obtain discounted loans for former Fannie Mae executives James Johnson, Franklin Raines, Jamie Gorelick and Daniel Mudd. The documents also show Mozilo’s close personal relationship with Johnson, with whom he negotiated the first strategic partnership agreement that formally linked Countrywide and Fannie Mae for the first time. Jimmie Williams was familiar with Johnson and Raines. He received referrals from Fannie Mae and passed them to the VIP unit. He stated:

Q And did you regularly get referrals from Fannie Mae, or was this sort of a unique experience?

A I remember getting a couple from Fannie Mae. Q And when you got referrals from Fannie Mae, what did you do with them?

A The same process. It was the same thing, same process, same number, same desk. 232 Countrywide processed loans for Fannie Mae employees who participated in an employee assistance program, which provided money that could be put toward a down payment. Cruz testified that the VIP team was familiar with these complicated loans and processed them frequently. She stated:

Q: Do you recall that Fannie Mae and Freddie Mac employees were frequently referred into the program?

A: Yes. Actually, more Fannie Mae than Freddie Mac, but anybody that wanted to access our unit would get an application in and we would process it. In fact, we were aware of the employee assistance program for Fannie Mae, which requires a little bit of process that some people didn’t want to get involved when you have to take care of that. So we did, being that they knew among their employees, they knew how we were able to take care of those things, then they would refer themselves to us to take care of those loans.

Q: So Fannie Mae employees who took advantage of their internal employee assistance program

A: Yes.

Q: — would be made aware of Countrywide’s A: Yes, that we were able to process that part of their transaction. Because it entailed to fill out some forms, get signatures, send it to another underwriter in Fannie Mae that would sign off and say , okay, the loan is okay for this part of the assistance. Because what it was, part of the down payment came from funds from Fannie Mae for them to purchase the property.

Jim Johnson James “Jim” Johnson became chairman and CEO of Fannie Mae in 1991. David Maxwell, former general counsel for the Department of Housing and Urban Development , had initially recruited him to join Fannie Mae.

Williams Tr. at 115 – 116. Shortly after assuming the top position at Fannie Mae , Johnson went on tour to meet with top executives at the 233 Rose Tr. at 162 – 165. Muolo and Padilla at 111. mortgage banking firms with which Fannie had business. In California, Johnson met Angelo Mozilo, whose company Countrywide was already selling conforming loans to Fannie Mae. 236 Fannie’s handled its business with Countrywide from Fannie Mae’s west coast office, “conveniently located right across the street from Countrywide’s headquarters.”

Williams Tr. at 115 – 116. Shortly after assuming the top position at Fannie Mae , Johnson went on tour to meet with top executives at the 233 Rose Tr. at 162 – 165. Muolo and Padilla at 111. mortgage banking firms with which Fannie had business. In California, Johnson met Angelo Mozilo, whose company Countrywide was already selling conforming loans to Fannie Mae. 236 Fannie’s handled its business with Countrywide from Fannie Mae’s west coast office, “conveniently located right across the street from Countrywide’s headquarters.”

Johnson and Fannie Mae accountants in charge of tracking the sources of the loans purchased by the GSE noticed Countrywide’s rapid growth. 238 Realizing Fannie Mae would be buying the majority of its loans in the future from non – bank mortgage companies like Countrywide, Johnson made an effort to court Mozilo. At the time, Countrywide was originating billions in loans and was on its way to becoming “the largest residential lender in the United States.”

“When Jim realized how much volume Countrywide was taking down, especially in California, he made it his mission to get to know Angelo,” said a Johnson aide. As the business ties between Countrywide and Fannie Mae grew stronger, so too did the personal ties between the two CEOs. When Mozilo ordered discounts and other forms of preferential treatment for Johnson and his friends and family, he frequently reminded staff how important Johnson was to the company. After waiving one and a half points on a loan for Johnson, Mozilo reminded David Kovnesky: “Jim Johnson continues to be a source of many loans for our Company and this is just a small token of my appreciation for the business that he sends to us and for his loyalty to the Company.” He did. Johnson and Mozilo became closely aligned. 242 When Mozilo was helping Johnson arrange a loan for his son, he e – mailed Carlos Garcia: “I agreed to make a loan to Jim Johnson’s [son’s] trust . . . . [I]f Jim need s to cosign, he will. It is important that we make this loan because of Jim’s help to the Company over many years. Please call Jim directly . . . and let me know if you need anything else.” 243 In an e – mail to Andrew Gissinger, Mozilo stated: “Jim is a very important customer.”

Johnson was described as a “big time FOA” in another internal e-mail. Mozilo’s message got through. When Underwriter Gene Soda was uncomfortable approving a loan to Johnson because of credit issues, he knew to seek further instructions rather than deny Johnson’s loan application. In the past these loans were just approved as directed. However, based on [the credit report] I’m concerned about signing on these loan s. These are obviously very high profile borrowers and lack of performance will be reported. I need some direction on how to proceed. In an e-mail to Managing Director David Spector, Soda wrote:

Mozilo ordered the loan approved, and gave Johnson a break. He instructed the VIP unit: “Charge him ½ under prime. Don’t worry about [the credit score]. He is constantly on the road and therefore pays his bills on an irregular basis but he ultimately pays them.”

When Condé Nast Portfolio and The Wall Street Journal broke the story of the VIP program in June 2008, Johnson’s legal team requested help from Countrywide in developing a public relations strategy. In an e-mail to Countrywide’s Chief Legal Officer, Johnson’s lawyer wrote: On behalf of Jim Johnson, I wanted to solicit Countrywide’s willingness to put out a brief statement simply noting that this was part of a regular business program at Countrywide that served hundreds of senior corporate executives and high – net worth clients (much as any private banking unit would at any lender), and was not specific to Johnson’s Fannie Mae connection.”

Mozilo obliged. He notified Countrywide’s public relations staff that Johnson was enrolled in the VIP program because he referred a lot of business to Countrywide. Mozilo wrote: Jim received no ‘special’ treatment . He has been the source of much business to Countrywide because of his confidence in us and knowing that we would treat anyone who comes to us fairly.

In fact, Countrywide gave Johnson special treatment to a greater extent than it did for any other VIP borrower. Mozilo made sure Countrywide went to great lengths to reward Johnson for his personal and professional relationship with the company. Johnson received the full suite of benefits from Countrywide’s VIP unit – from keeping Johnson’s purchase of a condominium in the Ritz Carlton secret from his wife so he could surprise her, to giving discounted loans to his son 252 and his maid, E – mail from Maritza Cruz to Gene Soda, Apr, 27, 2005 (CW – COGR – 0073839). to ignoring 80 credit issues and debt ratios 255 Additionally, Johnson was able to refer borrowers to the VIP unit.

In fact, Countrywide gave Johnson special treatment to a greater extent than it did for any other VIP borrower. Mozilo made sure Countrywide went to great lengths to reward Johnson for his personal and professional relationship with the company. Johnson received the full suite of benefits from Countrywide’s VIP unit – from keeping Johnson’s purchase of a condominium in the Ritz Carlton secret from his wife so he could surprise her, to giving discounted loans to his son 252 and his maid, E – mail from Maritza Cruz to Gene Soda, Apr, 27, 2005 (CW – COGR – 0073839). to ignoring 80 credit issues and debt ratios 255 Additionally, Johnson was able to refer borrowers to the VIP unit.

Johnson referred John Potter, Kent Conrad, and Donna Shalala to Countrywide, among others. when Johnson’s loans did not comply with lending standards. To assist Johnson’s lawyers, Countrywide quickly gathered data about the various loans Johnson received from Countrywide. The company’s own audit showed that Johnson received loans at below – market rates.

In an interview on National Public Radio’s Fresh Air, Morgenson described Johnson as “corporate America’s founding father of regulation manipulation.” Morgenson stated: This is a person who really, really wrote the blueprint for how to neutralize your regulator, how to manipulate Congress to get your way and, you know, essentially how to destroy your critics. And they just took no prisoners over those years. They were extremely hard – nosed, extremely aggressive and abrasive, and really understood how to make sure that they had friends in Congress at all times. Now, their regulator at that time was very weak. It was HUD, the Housing and Urban Development, and essentially what Johnson did, which was really amazing at the time, was to help write legislation in 1991 and ’92 which became the Safety and Soundness Ac t that was designed to prevent Fannie Mae and Freddie Mac from calling on taxpayers in a time of failure. Also according to Morgenson, Johnson changed Fannie’s executive compensation plan to reward volume rather than quality of loans. Johnson earned over $200 million while working at Fannie Mae.

Aaron Dykes is a co-founder of TruthstreamMedia.com, where this first appeared. As a writer, researcher and video producer who has worked on numerous documentaries and investigative reports, he uses history as a guide to decode current events, uncover obscure agendas and contrast them with the dignity afforded individuals as recognized in documents like the Bill of Rights.

Be the first to comment on "The Insider Trading Behind the Housing Crash: Bilderberg-linked Economic Collapse"