Robert Bonomo, Contributing Writer

Robert Bonomo, Contributing Writer

Activist Post

The SP 500 hit an apocryphal low during the financial crisis of 666 in March of 2009 from which point it has surged to more than double in price in about two years. This bull market is one of the most robust in US equities history; its only rivals are the end of the roaring 20s and the late 1990s.

There probably couldn’t be two more diametrically opposed moments in US history as the late 1990s and the post financial crisis period. The late 1990s were a period of massive innovation, relative peace, budget surpluses and low unemployment. The US military was resting on its laurels after a swift, definitive victory over Saddam Hussein and the once ominous Soviet threat had disappeared, mired in a decade of decay. Microsoft, Yahoo, Oracle, EBay and the like had made advanced technology once again part of the America brand after the 1970s and 80s when it seemed Japan would overtake the US as both the world’s dominant economy and innovator. But the nineties were a lost decade for the Japanese and saw a serous decline in their economic power relative to the United States. The 1990s were the culmination of an American century and victory in the Cold War; the long, sustained bull market made sense.

The post-2008 world has been a much different story.

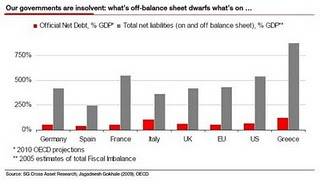

Unemployment is hovering around 10% (officially), budget deficits are reaching 10% of GDP and are almost as large as total government income if unfunded liablities are included. The Federal Reserve has begun a money printing campaign to buy mortgage backed securities and Treasury bonds. Throw in two seemingly unending wars, a host of new military actions, a housing market so dismal that one has to go back to the 1960s to find housing starts so low (when the population of the country was two thirds what it is today) and you have arguably the most bleak time in the nation’s history outside the Civil War.

Yet, in the face of this terrible economic, cultural, political and financial crisis, the markets act like it’s the end of the last century. So either the markets are extremely overpriced or the economy must be better than it seems. The reality is that the markets are priced below what there were in 2008 and continue lower. Those predicting doom and gloom and the SP at 400 were correct, they just weren’t looking at the right price.

The Dow/Gold chart describes the value of the Dow in gold. It shows a completely different picture than the Dow in dollars. Valued in gold, the Dow has not only be falling for the last 10 years, it is now substantially below the March 2009 lows, and sits currently around ’08. So what have we been witnessing over the last 10 years?

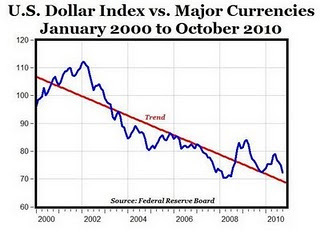

Clearly the value of the Dow has been declining relative to gold and to oil and only rising in terms of a depreciating dollar.

Imagine a fishing boat that pulls into a Mediterranean port with a catch of fresh fish. If on the first day 2 kilos of fish gets a bottle of wine, on the second it will be three kilos of fish for a bottle of wine. This doesn’t mean the value of the wine is increasing, it simply means the fish are worth less and less. But CNBC, the WSJ and the rest of the financial media insist we are in a bull market and do not explain that only because the dollar has lost more than a third of its value in the last ten years has the dollar denominated Dow “risen”. Against stable stores of value, oil or gold, the Dow has been in a steady decline for over ten years.

Modern fiat currencies are simply debt, unpaid IOU’s. This has been true since Richard Nixon took the US off the gold standard in 1971 when foreign central banks began demanding gold in exchange for their dollar reserves. Since that point the only thing backing up the US dollar has been the good faith of the government and citizens of the US to pay their debts. Logically, as the total amount of debt rises, the quality of the debt falls. A family that owes one year’s salary to the banks is a much better risk than one that owes 10 years salary to the banks. The US has somewhere in the vicinity of 7 years of GDP in debt if all public debt including unfunded liabilities (Social Security, Medicare, Medicaid) and household debt is included. The 600 trillion (officially) in estimated derivatives floating around the world, almost ten times world GDP, only highlights how completely devoid of any reality our current monetary system is.

Gold and Oil

Gold is and has been for centuries a trusted store of value and it can give us an unbiased view into the real value of things. If gold is the world’s preeminent store of value, oil is its most used store of energy. The historic cost of gold to oil should give insights into what the price of oil is now and what has been its historic level. From 1946 through 2010 the gold/oil ratio averaged around 15. As of May 2011, not surprisingly, it was almost exactly 15. Which means that in 1946 one ounce of gold bought around 15 barrels of oil, and it buys the same amount in 2011. Both the Dow/Gold graph and the Gold/Oil graph make it very clear that while our pundits, politicians, central bankers and mass media tell us we are in a ‘bull’ market, we have obviously been in a bear market for the last ten years. Why do our leaders obfuscate? What are the implications of telling the truth?

What Happened in 2008?

The financial crisis of 2008 caused a momentary reversal of this long-term trend by suddenely increasing the value of the dollar in terms of gold and oil and revealing the true value of the Dow. The sub prime mortgage debacle was an experiment in creating a new currency, one based not on debt in general, but specifically on US mortgage debt. When it blew up with declining home prices and defaults, the whole leveraged scheme needed to unwind and there was a frantic sell-off of assets to cover a massive dollar-denominated liquidity crisis. This drove the dollar up radically in price as demand for dollars became intense and, conversely, as the dollar became more expensive gold, oil and equities became much cheaper when priced in dollars. Once the Fed and the Treasury calmed the liquidity crisis, prices simply returned to their natural state and direction in the current “bull” market. The financial crisis was simply a hiccup in a long-term dollar debasement. It is very interesting to see how on the eve of the crisis, oil and gold were at a record highs and the dollar was at a record low; the financial crisis actually prolonged the life of the dollar.

Many have blamed borrowers for the financial crisis. Irresponsible deadbeats who brought down the world economy. Those who make this argument do not understand the first thing about banking. Banking is managing risk. Imagine someone is given one million dollars and told to lend it out, so she goes to a local mall, opens a booth with a sign that says “Have money, will lend” and spends the day lending money to people without verifying their income, job or assets. Would that person be called a banker or a fool? The difference between that person and banker is bankers can correctly measure and maintain their risk levels. Bankers have access to enormous swathes of data that can clearly show how defaults rise with falling prices and rising unemployment. They know that people don’t become less “ethical” during bad periods and more “trustworthy” during good periods. The borrowers are simply effected by changes in their environment. Bankers who tried to blame borrowers for the financial crisis are being disingenuous at best.

Why is there so little inflation if the dollar is collapsing?

This is the most riveting intellectual question of our time. Is deflation or inflation our fate? Again, gold, oil and the dollar do their dance. The largest holder of US debt is the Fed itself, followed by China, Japan and the OPEC states. The fact that the Fed can buy its own debt is the only reason the US is still a viable country. If the US had to buy euros or yen to pay its creditors and buy oil, the United States would already be a Third World country reeling in hyperinflation. The Chinese, the largest exporter to the US, artificially keep their currency low in order to maintain competitiveness and market share. The US plays the reserve currency game while the Chinese play the mercantilist game, and the glue that keeps it all together is the fact that oil has been priced in dollars since the mid seventies. The world needs dollars to do business and to buy oil, and those excess dollars come right back to the US and buy more US debt, keeping interest rates low, the dollar artificially high, and prices relatively stable.

Why doesn’t the Euro become the reserve currency?

This chart shows the debt levels of the European economies to be almost as bad as the US. The US “miracle” is that there is no “hard” currency in the world other than gold. If there were a hard currency based on gold or oil the dollar reserve status might disappear. Some have even speculated that Saddam Hussein and Muammar Qaddafi both made the very serious mistake of wanting to accept euros or gold for oil, thereby threatening the dollar hegemony. The yen is even more leveraged than the dollar, with debt levels reaching over 200% of GDP.

The danger of a reserve currency vacuum.

All major world currencies are fiat currencies backed by faith and the benchmark is the dollar. If the value of the dollar fell of a cliff, would markets “believe” that 70 Euros was really equal to a barrel of oil? While the dollar is flawed, the euro and yen are probably even less reliable long term stores of value as their fundamentals are similiar to the dollar but neither has a a massive military machine to do its bidding.

The importance of the dollar to the world economy should never be underestimated. The fact that dollars maybe traded for any commodity, currency or product, anywhere in the world is an amazing feat of modern trade and finance. This facility encourages businesses to invest in new projects, hire workers and take risks. In the hypothetical case of a dollar collapse and an interim period of confusion, the consequences would be catastrophic for the entire world. Trade would come to a screeching halt as exporters would be hard pressed to send product abroad not knowing the value of the currency they were to receive in exchange. This confidence in the dollar which has accompanied and played an integral role in globalization, if lost, could cause a massive unwinding that could throw the world economy into a terrible tailspin. The mercantilist Asian economies have devastated manufacturing in much of the the industrialized world. Without a fluid system of international payment shortages and chaos could ensue.

Perspective

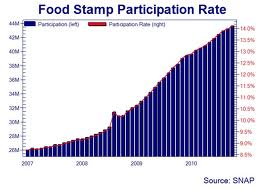

The United States is still the world’s economic and military superpower, but the empire is teetering the edge of disaster. Unfortunately, American leadership puts its faith in an erroneous exceptionalism instead of facing the facts and acting in a way that will safeguard American AND world stability, both of which are inherently connected. The precipitous rise in foods stamp use should make it abundantly clear that this parabolic ‘bull’ market is indeed a mirage.

The typical solution one will hear is austerity. ‘We can’t keep spending so much!’ ‘We must live within our means!’ etc… This way of thinking is absurd, has no connection to physical reality and, worst of all, is the mantra of bankers the world over. Forget the unemployment rate which is a complete fabrication created by the Bureau of Labor Statitistics for the Federal Reserve, along with the inflation rate and GDP growth rate. If we used real numbers, we would have negative GDP growth, double digit inflation and unemployment close to 20%. All of which means that there is an incredible amount of unused resources sitting idle in the percent of active age population not working and unused factory capacity. The only thing holding back the country is a sound monetary policy.

Put another way, if suddenly due to some horrific natural disaster we had to run all our factories at 90% capacity, and employ every able bodied man and woman willing to work in order to stave off a flood of biblical proportions, would we do it or would we simply give into the rising waters because we didn’t have enough money? We could expand GDP not by 5% but by 15% in one year by simply slashing the bankers Gordian digital debt with a the click of a mouse. When more money inherently means more debt, which means more interest, which in turns sucks up more resources to pay bankers, the system finally implodes as it is doing now. In the current paradigm growth means more debt, when growth should mean more work. We cannot continue to have bankers sucking the life out of the world economy while we wonder how to pay them back with new austerity measures.

The only austerity we need is a strong dose of it when paying bankers their so called principal and interest. We need a new dollar, based on some package of commodities or simply gold, one created and earned by work, not by debt.

Read more from Robert Bonomo at his blog, Cactus Land, which continues to explore

the ideas of his novel, Cactus Land available at Amazon.

linkwithin_text=’Related Articles:’

Be the first to comment on "The Fake Bull Market: A Dollar Mirage"