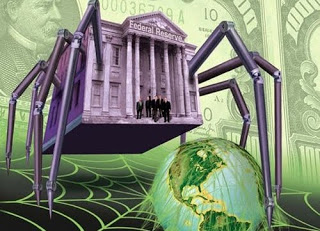

Ellen Brown

WebofDebt

The Fed is proposing another round of “quantitative easing,” although the first round failed to reverse deflation. It failed because the money went into the coffers of banks, which failed to lend it on. To reverse deflation, the money needs to be funneled directly to state and local economies.

In 2002, in a speech that earned him the nickname “Helicopter Ben,” then-Fed Governor Bernanke famously said that the government could easily reverse a deflation, just by printing money and dropping it from helicopters. “The U.S. government has a technology, called a printing press (or, today, its electronic equivalent),” he said, “that allows it to produce as many U.S. dollars as it wishes at essentially no cost.” Later in the speech he discussed “a money-financed tax cut,” which he said was “essentially equivalent to Milton Friedman’s famous ‘helicopter drop’ of money.” You could cure a deflation, said Professor Friedman, simply by dropping money from helicopters.

It seems logical enough. If there is insufficient money in the money supply (deflation), the solution is to put more money into it. But if deflation is so easy to fix, then why has the Fed’s massive attempts to date failed to do the job? At the Federal Reserve’s Jackson Hole summit on August 27, Chairman Bernanke said he would fight deflation with his whole arsenal, including “quantitative easing” (QE) – purchasing longterm securities with money created on a computer. Yet since 2008, the Fed has added more than $1.2 trillion to “base money” doing just that, and the economy is still in a serious deflationary spiral. In the first quarter of this year, the money supply actually shrank at a record annual rate of 9.6%.

Be the first to comment on "Time for Helicopter Ben to Drop Some Money on Main Street"