By Aaron Kesel

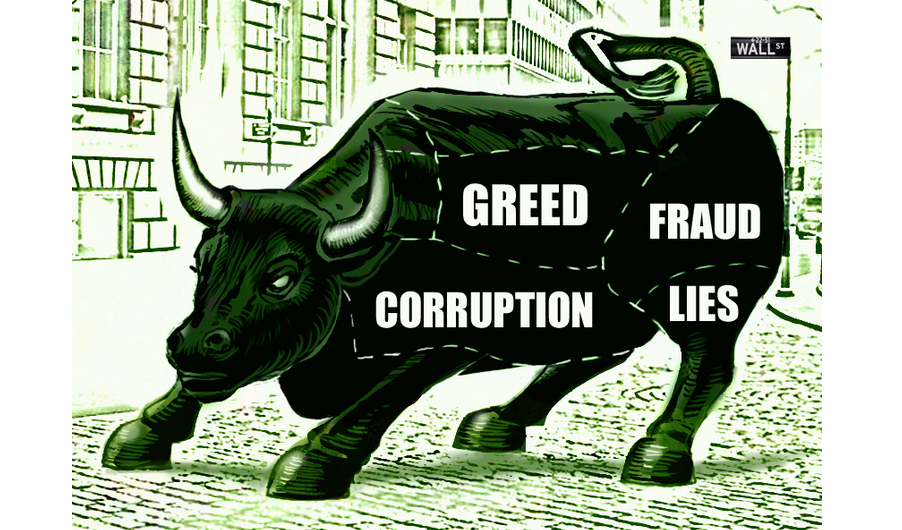

As this writer previously wrote, the new book The Chickenshit Club by Pulitzer Prize–winning journalist Jesse Eisinger remakes the DOJ into a bunch of “Chickenshit” actors who are far too gracious to the cabal of bankers; therefore, labeling them too big to fail and too big to jail.

This reporter has researched the evidence documenting that agents of justice would rather aid and abet Wall Street fraud, rather than investigate and prosecute Wall Street executives visible financial misdeeds.

One of these cases is known as The Learning Company merger.

In an era where POTUS wannabes seek to claim “retroactive” retirement, it would serve justice well, to take a step back in time where Goldman Sachs & Bain Capital appear to have become partners in unjust enrichment.

Wall Street executives partake in crony capitalism practices and organized illegalities, sometimes brazenly defrauding their own clients by all sorts of Machiavellian dirty tactics.

In 1997, Goldman Sachs aided Thomas Lee Partners, Mitt Romney and Bain Capital, to get involved with “The Learning Company” through a private equity firm.

Two years later in May 1999, the MNAT law firm (working for Goldman Sachs and Bain Capital in various deals) assisted “The Learning Co” to merge with Mattel toys.

Instant, catastrophic losses, in the billions, transpired in what is known to be one of the worst corporate mergers of all time. As Andrew Cave of the Telegraph reported,

The 3.6 billion acquisition of The Learning Company, an educational software firm, by Mattel took its place yesterday as one of the worst takeovers in recent history when the toymaker sold on the company for less than one-tenth of the purchase price.

[…]

Learning Company began losing money as soon as it was acquired and the resulting 59pc slump in Mattel’s shares has wiped out $3.1 billion of market capitalisation. Yesterday, Robert Eckert, Mattel’s new chief executive, announced 350 job losses, a $250m restructuring charge and a dividend cut from 9 cents a quarter to 5 cents a year with the aim of saving $200m a year.

It appears that Goldman Sachs and Bain Capital cooked the books and sold the skeleton for a bloated price which ultimately cost Mattel billions. Then covered their tracks by hiring US Attorneys.

Suspiciously, Colm Connolly who was the DE Assistant U.S. Attorney at the time of the case, for seven years, “switched sides” to become a partner of the MNAT law firm.

There appears to be no federal investigation into who scammed whom by cooked books (could anyone seriously genuinely argue Mattel’s inside and outside auditors are really that incompetent?).

Stay tuned as I continue to document these “revolving doors” incidences of federal agents and Wall Street executives or lawyers obstructing justice. Any attentive reader will see that calling these rackets “Chickenshit” is being incredibly soft on conspiracy to commit mass fraud that used to be prosecuted under RICO laws.

Visibly, racketeering enterprise has infected federal agencies to the point where betrayals of the public’s trust has become the rule, instead of the exception…

This is only part 2 in this series that documents financial misdeeds; I’m kicked back sipping my lemonade waiting for the proper authorities to do something rather than act like this doesn’t exist, and I will continue to release evidence.

Aaron Kesel writes for Activist Post and is Director of Content for Coinivore. Follow Aaron at Twitter and Steemit. This article is Creative Commons and can be republished in full with attribution.

Like Activist Post on Facebook, subscribe on YouTube, follow on Twitter and at Steemit.

Image Credit: Anthony Freda

judges and connected lawyers helping to rip of individuals and companies..no way. hah hah