By Susan Boskey

By Susan Boskey

From the Great Recession to the Grand Illusion of recovery, growing household debt and the number of families struggling to make ends meet is the story left behind the curtain. Only a few leaders, authors and bloggers expose the underbelly reality hoping for strength in the numbers of those who wake up to the window dressing. As Charles Hugh-Smith puts it, “Welcome to debt-serfdom, the only possible output of the soaring cost of living for the unprotected many who are ruled by a hubris-soaked, subsidized Protected Elite.”

I could not have said it better, myself. Yet first-world culture appears to be all about looking good for those in it even if living in a world of hurt.

I could not have said it better, myself. Yet first-world culture appears to be all about looking good for those in it even if living in a world of hurt.

Not unlike the story of The Emperor’s New Clothes, we’re supposed to go along to get along and never mention the emperor is butt naked, i.e. that you’re living precariously on the edge. As an issue deemed “negative” in a “think positive” world and way too personal to talk about, people tend to consider they are the only ones navigating rough financial waters. Conversation must stay upbeat. However, this tacit agreement to silence seems to only eventually lead them to deeper and murkier circumstances, until they are betrayed as if by a cheating spouse.

Methinks suffering in silence (by the little guys) is part of the big guys’ strategy to assure the longevity of their own financial domination. All along, you honestly believed you were doing everything you were supposed to because that’s what the experts said to do. But, alas, you learned the hard way. Bad news for you; good news for the Emperor.

Given corporate commerce has the mandate of a profitable bottom line, if to stay in existence, markets must expand and sales must grow. Marketing and advertising serves to cloud the non-commercial human’s innate ability to recognize their array of choices as they head down the road of increased consumption. The banking industry touts the benefits of their product, credit, and since everyone else relies on credit, why not? Some call the outcome, debt-slavery.

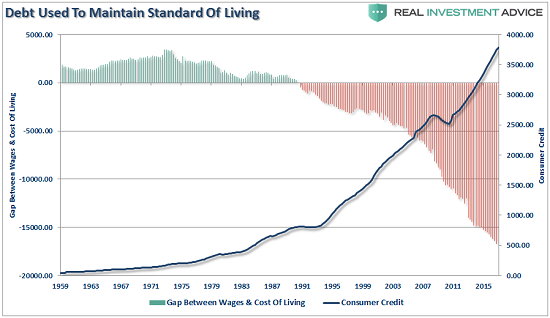

Despite the distraction of a booming stock market promoted as an expression of a healthy economy, the household debt levels tell another story; they surpass debt levels of the Great Recession in 2008. The Federal Reserve reports on household debt for the 1st quarter of 2017.

Aggregate household debt balances increased in the first quarter of 2017, for the 11th consecutive quarter, finally surpassing the 2008Q3 peak of $12.68 trillion. As of March 31, 2017, total household indebtedness was $12.73 trillion, a $149 billion (1.2%) increase from the fourth quarter of 2016. Overall household debt is now 14.1% above the 2013Q2 trough.

A Bankrate Inc. January 2017 survey revealed 57% of American respondents (6 of 10) didn’t have enough cash to cover a $500 unexpected expense. Almost half of the 1,003 adults surveyed said they or a member of their family were hit with a major expense in the past year.

However, if you discern with eyes wide open, you can see marketing manipulation for what it is. Greater awareness brings into focus the greater range of choices available to you beyond those prescribed by a marketplace that benefits at your expense. With a curiosity to advance your financial IQ, alternatives to traditional wealth building and management start to make sense.

However, if you discern with eyes wide open, you can see marketing manipulation for what it is. Greater awareness brings into focus the greater range of choices available to you beyond those prescribed by a marketplace that benefits at your expense. With a curiosity to advance your financial IQ, alternatives to traditional wealth building and management start to make sense.

What this proves, in my estimation, is that suffering in silence does advance the cause of financial and personal well-being in the lives of everyday people. Bottom line, the problem is systemic, not personal. Until more people are willing to discover how the monetary system undermines their best efforts, and speak up about it, I fear more suffering behind closed doors.

Susan Boskey is author of the book, The Quality Life Plan®: 7 Steps to Uncommon Financial Security. After exposing the bottom-line of why more and more families need credit each month just to make ends meet, Susan provides game-changing practical strategies, tactics and templates to help you create a life of greater ease. You can reverse the downward trend of credit and debt while learning how to establish a long-term, debt-free lifestyle; a life that allows you to build both financial wealth and the wealth of well-being midst the challenges of today. To learn more or to purchase the book, please visit her website at http://TheQualityLifePlan.com

Image Credit: Pixabay

Well, I would say debt is used to rob the whole world.

Debt is not the worst of it. The worst of it is usury, which guarantees that one never gets out of debt since it is constantly compounding. If money supply was reasonably controlled or constant and interest on loans did not exist debt would be repayable. The added condition for repayable debt would have to be morally justified compensation for labor or services rendered. Since we don’t have either of these conditions, i.e. we have currently bare subsistence wages and inflated money supply (accessible only to the rich), the average person will be perpetually behind the eight ball in a losing struggle to survive. When the struggle becomes unbearable things come apart.

Which is why many citizens just declare bankruptcy and refuse to play their game anymore Dimitri. They try and scare people and persuade them to never do this or it will ruin their “credit.” Well the truth is if enough people did this it would ruin their “system.”

Botswana – Been there, done that… twice. Enough people are too terrorized by the system to defend themselves.

It’s the White Rabbit in the Room, but people have been conditioned into not seeing it… More Loans, Mortgages, Holidays and University Fees. That’s better..! People are conditioned into wanting this Plague.