Last time around it was subprime mortgages, but this time it is oil that is playing a starring role in a global financial crisis. Since the start of 2015, 42 North American oil companies have filed for bankruptcy, 130,000 good paying energy jobs have been lost in the United States, and at this point 50 percent of all energy junk bonds are “distressed” according to Standard & Poor’s. As you will see below, some of the big banks have a tremendous amount of loan exposure to the energy industry, and now they are bracing for big losses. And the longer the price of oil stays this low, the worse the carnage is going to get.

Today, the price of oil has been hovering around 29 dollars a barrel, and over the past 18 months the price of oil has fallen by more than 70 percent. This is something that has many U.S. consumers very excited. The average price of a gallon of gasoline nationally is just $1.89 at the moment, and on Monday it was selling for as low as 46 cents a gallon at one station in Michigan.

But this oil crash is nothing to cheer about as far as the big banks are concerned. During the boom years, those banks gave out billions upon billions of dollars in loans to fund exceedingly expensive drilling projects all over the world.

Now those firms are dropping like flies, and the big banks could potentially be facing absolutely catastrophic losses. The following examples come from CNN…

For instance, Wells Fargo (WFC) is sitting on more than $17 billion in loans to the oil and gas sector. The bank is setting aside $1.2 billion in reserves to cover losses because of the “continued deterioration within the energy sector.”

JPMorgan Chase (JPM) is setting aside an extra $124 million to cover potential losses in its oil and gas loans. It warned that figure could rise to $750 million if oil prices unexpectedly stay at their current $30 level for the next 18 months.

Citigroup is another bank that also has a tremendous amount of exposure…

Citigroup (C) built up loan loss reserves in the energy space by $300 million. The bank said the move reflects its view that “oil prices are likely to remain low for a longer period of time.”

If oil stays around $30 a barrel, Citi is bracing for about $600 million of energy credit losses in the first half of 2016. Citi said that figure could double to $1.2 billion if oil dropped to $25 a barrel and stayed there.

For the moment, these big banks are telling the public that the damage can be contained.

For the moment, these big banks are telling the public that the damage can be contained.

But didn’t they tell us the same thing about subprime mortgages in 2008?

We are already seeing bank stocks start to slide precipitously. People are beginning to realize that these banks are dangerously exposed to a lot of really bad deals.

If the price of oil were to shoot back up above 50 dollars in very short order, the damage would probably be manageable. Unfortunately, that does not appear likely to happen. In fact, now that sanctions have been lifted on Iran, the Iranians are planning to flood the world with massive amounts of oil that they have been storing in tankers at sea…

Iran has been carefully planning for its return from the economic penalty box by hoarding tons of oil in tankers at sea.

Now that the U.S. and European Union have lifted some sanctions on Iran, the OPEC country can begin selling its massive stockpile of oil.

The sale of this seaborne oil will allow Iran to get an immediate financial boost before it ramps up production. The onslaught of Iranian oil is coming at a terrible time for the global oil markets, which are already drowning in an epic supply glut.

Just the other day, I explained that some of the biggest banks in the world are now projecting that the price of oil could soon fall much, much lower.

Morgan Stanley says that it could go as low as 20 dollars a barrel, the Royal Bank of Scotland says that it could go as low as 16 dollars a barrel, and Standard Chartered says that it could go as low as 10 dollars a barrel.

But the truth is that the price of oil does not need to go down one penny more to have a catastrophic impact on global financial markets. If it just stays right here, we will see an endless parade of layoffs, energy company bankruptcies and debt defaults. Without any change, junk bonds will continue to crash and financial institutions will continue to go down like dominoes.

We are already experiencing a major disaster. Things are already so bad that some forms of low quality crude oil are literally selling for next to nothing. The following comes from Bloomberg…

Oil is so plentiful and cheap in the U.S. that at least one buyer says it would pay almost nothing to take a certain type of low-quality crude.

Flint Hills Resources LLC, the refining arm of billionaire brothers Charles and David Koch’s industrial empire, said it offered to pay $1.50 a barrel Friday for North Dakota Sour, a high-sulfur grade of crude, according to a corrected list of prices posted on its website Monday. It had previously posted a price of -$0.50. The crude is down from $13.50 a barrel a year ago and $47.60 in January 2014.

While the near-zero price is due to the lack of pipeline capacity for a particular variety of ultra low quality crude, it underscores how dire things are in the U.S. oil patch.

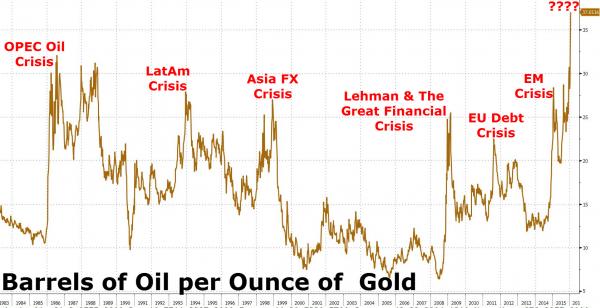

A chart that I saw posted on Zero Hedge earlier today can help put all of this into perspective. Whenever the price of oil falls really low relative to the price of gold, there is a major global crisis. Right now an ounce of gold will purchase more oil than ever before, and many believe that this indicates that a new great crisis is upon us…

The number of barrels of oil that a single ounce of gold can buy has never, ever been higher.

All over the planet, big banks are absolutely teeming with bad loans. And to be honest, the big banks in the U.S. are probably in better shape than some of the major banks in Europe and Asia. But once the dominoes start to fall, very few financial institutions are going to escape unscathed.

All over the planet, big banks are absolutely teeming with bad loans. And to be honest, the big banks in the U.S. are probably in better shape than some of the major banks in Europe and Asia. But once the dominoes start to fall, very few financial institutions are going to escape unscathed.

In the coming days I would expect to see more headlines like we just got out of Italy. Apparently, Italian banks are nearing full meltdown mode, and short selling has been temporarily banned. To me, it appears that we are just inches away from full-blown financial panic in Europe.

In the coming days I would expect to see more headlines like we just got out of Italy. Apparently, Italian banks are nearing full meltdown mode, and short selling has been temporarily banned. To me, it appears that we are just inches away from full-blown financial panic in Europe.

However, just like with the last financial crisis, you never quite know where the next “explosion” is going to happen next.

But one thing is for sure – the financial crisis that began during the second half of 2015 is raging out of control, and the pain that we have seen so far is just the beginning.

Michael Snyder is a writer, speaker and activist who writes and edits his own blogs The American Dream and Economic Collapse Blog. Follow him on Twitter here.

BWAHAHAHAHA!!! Fools!! Fools all of them, those who refused to see the fallacy of being able to create unlimited amounts of bookkeeping entries (fiat paper currencies) and not having to deal with any ill effects!! When you have a system of unjust weights and measures, it always, always, always kills itself off!

But so what if these banks all fail due to their own evil deeds?? The banksters are the REAL “useless eaters” of the world. They consume much, but provide no benefits at all, not even the lesson of why we shouldn’t trust banksters, because that lesson never seems to be learned. It’s the same way with politicians. They cause more problems than they ever solve, and societies over the years eventually rise up and kill most of them off, but then after a few years go by, suddenly politicians spring up again and the whole thing begins anew. So there we have two big lessons which never seem to be learned by anyone. What will it ever take before we learn the lessons and stop allowing politicians and banksters to ruin our life??

I was considering helping them along, by taking my money out of the Bank!

You can do what you want to, I won’t lift a single finger to stop you! Just realize that what you “take out of the bank” isn’t really money at all, just some fiat paper currency of NO known or provable value!! If you use that paper to get something that you feel will be able to serve you later on down the line, well great and welcome to the club! And keep in mind that capital controls are only going to get worse the longer you delay.

I am aware, and am prepared in every way possible. My prayer is that those of the American people are doing so as well.

You don’t take your money out of the bank.

You ask them to repay the loan you advanced to them.

Everybody must do it at the same time and crash the system once and for all

Oil has dropped by a factor of nearly 4 from its high of $110/bbl. The only other commodity I can remeber dropping this order of magnitude was silver from a high of about $50/ounce. The silver crash was quickly blamed on market speculators, yet oil’s crash is blamed on supply/demand. Has there ever been another commodity price drop of this magnitude that was due to supply/demand rather than speculators?

Oil reached a high of $147 per barrel at it`s height and now down to $30.00 ? This shows me just hoe badly rigged this oil market really is . If there was a shortage previously to force the price so high how come there is now such a glut to force the price down so low ? It is not natural for any market to swing that much but oil is the basis for the whole financial system and I don`t think ANYONE foresaw this did they ?

Putin did! What a brilliant Christian man. When he and Trump team up, it will be the end of the New Word Order, Jeckyl Island schemers for a long, long time. We can rewrite “The Hunger Games” series, and have the Bush clan vs. the Klinton/Obamanite clan. Payback is a beeyatch!

Thats a good point, William. The ‘system’ we are controlled by was never really broken; it was ‘designed’ that way. The elite will come out on top though, they always do. However, all the money in the world won’t save them from our wrath!

The real wrath will be the wrath of God which will destroy all evil and subject it to the second death, eternity in the lake of fire.

Everyone who has studied the bible seen it coming, it is very informative and everything is written.

I have been telling people about markets collapsing since 1996, the year when I found out how the fiat paper currency financial system is really set up. All it took was a little bit of logical reasoning to see what the point of ne plus ultra was, which is a complete crash of ALL fiat currencies in every country. NONE will be spared. Just as all of the religions of the world can be shown to be dependent upon fraud of some kind to exist, so too are all of the monetary systems on Earth and elsewhere, if there is an elsewhere. No one can show me even just one little corner of the world where no fraud exists.

Dare you evil low-lifes try that “too-big-to-fail” bail-out schem again!!!

Oh, wait. Little sweatty Teddy won’t have Goldman Sachs to bail him out

any more. Never mind………… Go Donald; crush all those weasels

and prostitutes in the elephant tent!!!

The Deep State is trying to provoke Russia into a shooting war. Now that’s where the REAL money can be made.