SARTRE

SARTRE

Activist Post

The names Catherine Engelbrecht and Reggie B. Walton may not exactly be household names, but both are part of a disturbing court ruling that can only be described as a reprehensible government protection racket in plain sight for all to see. Ms. Engelbrecht was the plaintiff and Reggie B. Walton the judge. A succinct summary is provided by Breitbart in the report, True the Vote’s Lawsuit against IRS Gets Tossed by Federal Judge.

A federal judge in the United States District Court for the District of Columbia entered an order dismissing a lawsuit filed by True the Vote, a Houston, Texas-based non-profit organization focused on “voters’ rights and election integrity” against the Internal Revenue Service (IRS). The order alleged that the IRS had improperly delayed granting their application for 501(c)(3) status and targeted them as a conservative organization. The opinion, by Judge Reggie B. Walton, found that the IRS had taken sufficient “remedial steps to address the alleged behavior.”

From the ruling by Judge Walton, analysis:

The defendants contend that the Court does not have subject-matter jurisdiction over counts one, two, and five of the plaintiff’s complaint because the IRS ultimately approved the plaintiff’s application for tax-exempt status, and thus counts one, two, and five—all of which seek “to correct [the] alleged targeting [of the IRS] and delay during its application process” for tax-exempt status—are now moot as there is no longer any case or controversy for the Court to resolve.

How nice that the IRS can slip out of a sticky wicket by simply retroactively approving a 501(c)(3) application that they officiated with a touch of harassment and a sprinkle of intimidation. The reasoning used by Judge Walton to protect the IRS from a “voluntary cessation” exception follows:

The rationale supporting the defendant’s voluntary cessation as an exception to mootness is that, while the defendant’s unilateral cessation of the challenged conduct may grant the plaintiff relief, the defendant is free to return to its old ways—thereby subjecting the plaintiff to the same harm but, at the same time, avoiding judicial review. Accordingly, a case can be mooted by virtue of the defendant’s cessation of its allegedly illegal conduct only if (1) there is no reasonable expectation that the conduct will recur and (2) interim relief or events have completely and irrevocably eradicated the effects of the alleged violation.

Oh praise the sacred high priests of the Internal Revenue Service for “seeing the light” and repenting their ways. Such a reasonable trust in the good intentions of the IRS to not only follow the law but to administer their trade under the “good faith” doctrine that only a judge working for the same corrupt government as do the Lois Lerner brigade of bureaucrats, would profess.

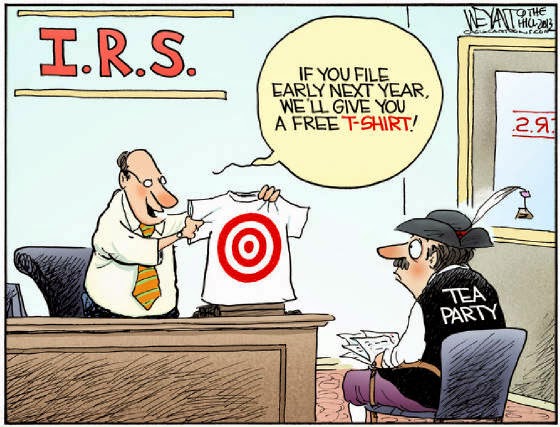

An important USA Today article, from hardly an anti–government publication, IRS list reveals concerns over Tea Party ‘propaganda’, furnishes the evidence.

Newly uncovered IRS documents show the agency flagged political groups based on the content of their literature, raising concerns specifically about “anti-Obama rhetoric,” inflammatory language and “emotional” statements made by non-profits seeking tax-exempt status.

The internal 2011 documents, obtained by USA TODAY, list 162 groups by name, with comments by Internal Revenue Service lawyers in Washington raising issues about their political, lobbying and advocacy activities. In 21 cases, those activities were characterized as “propaganda.”

The list provides the most specific public accounting to date of which groups were targeted for extra scrutiny and why. The IRS has not publicly identified the groups, repeatedly citing a provision of the tax code prohibiting it from releasing tax return information.

The supporting items Document: IRS ‘political advocacy cases’ list, while the pattern of selective favoritism is authenticated in the report, IRS approved liberal groups while Tea Party in limbo.

The supporting items Document: IRS ‘political advocacy cases’ list, while the pattern of selective favoritism is authenticated in the report, IRS approved liberal groups while Tea Party in limbo.

For a more cutting-edge analysis from Twitchy US politics on the insanity from the Loony Left, just absorb the rhetoric and ask, who the real totalitarians are in society and even worse in government. Outrage: Court acknowledges that IRS targeted True the Vote, dismisses lawsuit anyway explains.

Voters’ rights group True the Vote , a nonprofit “founded to inspire and equip voters for involvement at every stage of our electoral process,” has had a hard time of it. As the 2012 election approached, Cher of all people referred to True the Vote as “a bunch of Tea Party Nazis” and “animals.” Maryland Rep. Elijah Cummings, who sits on the House Oversight and Government Reform Committee, informed True the Vote founder and president Catherine Engelbrecht that he would be launching an investigation into her organization. < Of course, all of this was happening while the IRS was targeting conservative groups and holding up applications for nonprofit status, often through several election cycles. And even though the U.S. Federal District Court didn’t deny this, True the Vote’s case against the IRS was dismissed today.

Engelbrecht issued the following brief statement:

The Court today correctly acknowledged that the IRS targeted True the Vote because of its perceived political beliefs. Such conduct is reprehensible and should never be acceptable in a free society. Despite this critical finding, we are stunned and disappointed in the court’s ruling which nevertheless dismisses our case. We will be evaluating our legal options and will announce our intent in that regard soon.

Jenny Beth Martin, co-founder of Tea Party Patriots reaction to the DC Court Decision on IRS “Unconscionable”. “The Court’s decision not to sanction either the IRS or the individual agents because it and they had taken “remedial measures” is unconscionable.”

Supporting this conclusion are Top 9 Quotes on the IRS Targeting of Tea Party Groups.

1. “Not even a smidgen of corruption.” – President Barack Obama to Fox News’ Bill O’Reilly February, 2014

2. “Decline to answer that question.” – Lois Lerner, pleading the Fifth Amendment before the House Oversight and Government Reform Committee, March 5, 2014

3. “The IRS used inappropriate criteria that identified for review Tea Party and other organizations applying for tax-exempt status based upon their names or policy positions instead of indications of potential political campaign intervention.” – Treasury Inspector General for Tax Administration Audit

4. “Instead of referring to the cases as advocacy cases, they actually used case names on this list. They [Determinations Unit in Cincinnati, Ohio] used names like ‘Tea Party’ or ‘Patriots’ and they selected cases simply because the applications had those names in the title. That was wrong, that was absolutely incorrect, insensitive, and inappropriate.” – Lois Lerner

5. “Even after admitting that it had targeted groups, and a TIGTA [Treasury Inspector General for Tax Administration] report detailed the abuses, the IRS did not let up. In August 2013, the IRS requested yet more documents and information. It asked us to provide, for example, all fundraising communications for the 60 days before the November 6, 2012 election, and all materials that we used in various “Get Out the Vote” activities. That request made no sense under the current standards for evaluating non-profit applications. The regulations proposed three months later, however, explain the requests, as they include specific provisions classifying any mention of a candidate’s name within 60 days of an election and get-out-the-vote efforts as taxable political activity.” – Jenny Beth Martin in testimony to the House Committee on Oversight and Government Reform, February 27, 2014

6. “The Internal Revenue Service says acting IRS Commissioner Steven T. Miller was first informed in May 2012 that tea party groups were inappropriately targeted for scrutiny.” – Hot Air, May 13, 2013

6. “The Internal Revenue Service says acting IRS Commissioner Steven T. Miller was first informed in May 2012 that tea party groups were inappropriately targeted for scrutiny.” – Hot Air, May 13, 2013

7. “The IRS inspector general said this week that while some liberal groups were given extra scrutiny by the tax agency, they were not subjected to the same invasive queries as tea party groups – a finding that seems to confirm political bias was at play.” – The Washington Times, June 27, 2013

8. When the IRS revelations broke, Obama promised a full investigation. Yet Cleta Mitchell, an attorney for a number of tea party and conservative groups targeted by the IRS, testified, “None of my clients have received a single contact from the FBI, the DOJ [Department of Justice] or any other investigator regarding the IRS scandal.” – The Chicago Sun-Times, February 10, 2014

9. More than 400,000 documents have been turned over to Congress, only a fraction of which have been publicly released under the Freedom of Information Act. Republicans say they’re still missing key documents including the e-mails of former IRS Exempt Organizations Director Lois Lerner. – USA Today, February 26, 2014

But remember, President Obama assures us there’s “not a smidgen of corruption!”

No matter your political leanings, every American should be concerned when the courts condone abusive and arbitrary administration in any agency. Allowing the IRS to retroactively cover their rear, while turning a blind eye to systemic illicit practices, is just part of the game plan that permits the court to make up law, which favors government tyranny.

The True the Vote decision is insulting and only goes to prove that reforms through the election process are truly the moot option.

Original article archived here

SARTRE is the pen name of James Hall, a reformed, former political operative. This pundit’s formal instruction in History, Philosophy and Political Science served as training for activism, on the staff of several politicians and in many campaigns. A believer in authentic Public Service, independent business interests were pursued in the private sector. Speculation in markets, and international business investments, allowed for extensive travel and a world view for commerce. SARTRE is the publisher of BREAKING ALL THE RULES. Contact batr@batr.org

Be the first to comment on "Court Protects IRS Tyranny"