James Hall

James Hall

Activist Post

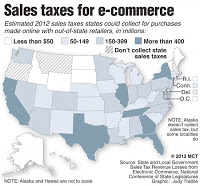

Before you panic that your online purchases will be tagged with the added cost of state sales tax, rely on the complexity of reporting sales to all the jurisdictions as your prime safeguard from forking over a percentage on every purchase. The Senate bill, Summary: S.336 provides a succinct description of the requirements. For a comprehensive resource on all you want to know about Marketplace Fairness Act Information, check out the details.

House Judiciary Chairman Bob Goodlatte in the article, Online sales tax bill may be dead on arrival in House, identifies concern that the practical difficulties remain with implementation.

I do not believe legislation like the Marketplace Equity Act is sufficiently simplified yet. While it attempts to make tax collection simpler, it still has a long way to go.

An illustration of this worry is evident in the maze of collection for Internet Sales Tax: A 50-State Guide to State Laws.

If you are selling goods or products online, you need to be aware of Internet sales tax rules. The issue of whether to require online retailers to collect sales tax in states where they have no physical presence has been a matter of significant debate in many states and at the federal level. Some states have enacted legislation that will require large online sellers to collect sales tax. These laws, sometimes referred to as “Amazon laws,” have been enacted in a number of states and are being considered in many others.

Up to now, the penalty for circumventing the collection and reporting process seems to be so burdensome that effective enforcement was impractical. The article, Internet Sales Tax: Here Come the Auditors, describes the intended abidance measures in the proposed Marketplace Fairness Act.

There are more than 9,600 state and local taxing jurisdictions in the U.S., and small businesses would be required to send the appropriate number of tax dollars-state and local-to every one where they sell.

And if the business owner makes a mistake? Or if the state thinks that the business owner makes a mistake? The bill provides for “a single audit of a remote seller for all State and local taxing jurisdictions within that State.”

This provision is intended to streamline the process, but it still means every business could face 46 separate audits (from the 45 states that collect sales taxes plus the District of Columbia).

Now, if you are one of those tax objectors that go to great length to evade paying state sales tax, you may applaud the latest effort in Congressional conflict to nix compliance with existing statutes. Hitherto, not everyone shares this disdain. The argument for equity and fairness is made in the essay; Online sales tax bill could crash in House.

Groups like the National Governors Association have said that states could badly use the roughly $23 billion in lost revenue they’re currently missing out on, and the National Retail Federation and the Retail Industry Leaders Association say the proposal would simply roll back the unfair advantage that online shopping outlets have on brick-and-mortar stores.

The bill, supporters stress, would have no affect on federal revenues, and would simply allow for the collection of sales taxes that consumers already owe but rarely pay.

This reliance on playing the fairness card to extract more revenue by closing the collection and accounting loophole assumes that the consumer is duty bound to just keep paying the burden for ever-expanded government budgets. Completely absent from the debate is whether the existing sales tax rates are excessive to begin with. This dialectic trap has government tax collectors avoiding any reevaluations of the formula for revenue enhancements.

The logical alternative for implementing an Internet sales state tax is to reduce the existing individual state sales taxes on brick-and-mortar businesses to maintain a revenue neutral offset. States have the ability to impose their own sales tax rates. However, the notion that Internet sales receipts need to be taxed to increase the coffers of state treasuries does nothing to reduce the rate of increases in public budgets, much less reducing expenditures in real dollars.

The logical alternative for implementing an Internet sales state tax is to reduce the existing individual state sales taxes on brick-and-mortar businesses to maintain a revenue neutral offset. States have the ability to impose their own sales tax rates. However, the notion that Internet sales receipts need to be taxed to increase the coffers of state treasuries does nothing to reduce the rate of increases in public budgets, much less reducing expenditures in real dollars.

The potential for such a reasonable approach to fiscal sanity is entirely out of whack, with the nature of political parasites. Tax collection has little fiscal relationship with raising funds to run government.

Taxation is primarily about behavior control.

Internet-savvy consumers seek competitive products and services online. Their method of unconventional payment presents another issue for the sponsors of this proposed legislation. One example is described in the analysis, What an Internet Sales Tax Could Mean for Your Bitcoin Stash.

This means that under the Marketplace Fairness Act, some online transactions could conceivably escape the Internet sales tax if bitcoins are the medium of exchange. Here’s how. Retailers like Amazon charge sales tax for certain jurisdictions already, based on your shipping address. Bitcoins, however, aren’t associated with any address at all-that’s the whole point. If you pay for a book in bitcoins but have it shipped to your house, calculating the tax would be easy. But we regularly buy all sorts of digital goods now that don’t get shipped anywhere-music and software, to name two examples.

None of this is to suggest that bitcoin-based transactions are or should be exempt from online sales taxes – just that collecting them presents a new challenge. On the one hand, this could play out badly for Bitcoin if the ambiguity discourages retailers from adopting the tender. On the other hand, it also creates the possibility of a loophole. “Oops,” the businesses will tell the states. “We can’t collect this tax for you because the customer paid in bitcoins and we don’t know where he or she lives.”

If public consumers and taxpayers accept sales tax as a legitimate structure of payment to their respected state governments, the inclusion of Internet sales seems to be a reasonable inclusion. All the same, the federal government has limited jurisdiction into the collection practices of individual states. Allowing careerist politicians and bureaucrats, free reign to add layers of complexity and punitive penalties that tracks personal purchasing patterns is another nail in the coffin of personal privacy. Overall, S.336 is a bad bill.

Original article archived here

James Hall is a reformed, former political operative. This pundit’s formal instruction in History, Philosophy and Political Science served as training for activism, on the staff of several politicians and in many campaigns. A believer in authentic Public Service, independent business interests were pursued in the private sector. Speculation in markets, and international business investments, allowed for extensive travel and a world view for commerce. Hall is the publisher of BREAKING ALL THE RULES. Contact batr@batr.org

linkwithin_text=’Related Articles:’

Be the first to comment on "Internet and Sales Taxes Dialectic"