|

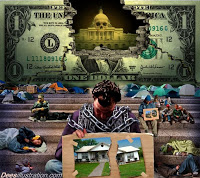

| Dees Illustration |

French businessman and economist Jean-Baptiste Say is credited with identifying the fundamental economic principle that aggregate demand for goods in an economy will equal the aggregate supply of goods when markets are permitted to operate. Or in Say’s words, “products are paid for with products.”

English classical economist David Ricardo, among others, more fully developed this principle into what has become known as “Say’s Law.” Say’s Law, according to Ricardo, leads us to understand that market equilibrium for goods is constant. This simply means that markets, when left alone by government planners or other fraudulent actors, inexorably tend toward an “equilibrium price” which eventually balances supply and demand for any particular good. Thus markets will clear themselves of any surpluses or shortages in the form of excess supply and demand.

This important corollary of Say’s Law– that markets clear– is critical to understanding the moribund US housing market. In housing, perhaps more than any other good, we see the terrible consequences of government and central bank interference with market forces.

First, the Federal Reserve Bank relentlessly increased the money supply over the last few decades. Much of this newly created money and credit flowed from Fed member banks into the residential and commercial real estate markets, causing prices to rise dramatically prior to the housing bust of 2007.

At the same time, the Fed systematically suppressed interest rates for decades. This led to tremendous malinvestment both by homebuilders and individuals, and encouraged a seedy subprime mortgage industry to make nonviable loans that would not make economic sense under market interest rates.

Congressional meddling in the mortgage market also added tremendously to the problem. Inane legislation like The Community Reinvestment Act literally forced banks to make thousands of loans to bad credit risks. Similarly, Fannie Mae and Freddie Mac put taxpayers on the hook for millions of mortgages that never would meet market underwriting criteria. And of course the real estate and homebuilder lobbies made sure mortgage interest debt (unlike most personal debt) remains tax-deductible.

The ultimate result of these interventions by our caring friends in Congress and the Fed has been the biggest housing bubble and crash in US history, leaving millions of Americans underwater on their mortgages if they have not already lost their houses altogether. Congress and the Fed are directly responsible for millions of shattered lives, and almost unknowable economic damage in the form of trillions of dollars in mortgage backed securities.

The only solution to this mess is to allow the US housing market to clear. All of the bad mortgage debt must be liquidated, whether via foreclosure or bankruptcy. Banks holding substantial mortgages or mortgage backed assets must face the music and adjust their balance sheets to reflect today’s reality. Undoubtedly this will force many banks into immediate insolvency, but such banks must be allowed to fail without receiving another nickel of taxpayer money. Banks took the risks and made money during the bubble years; those who exercised bad judgment must now accept the consequences of their actions.

Never in American history have we needed to adopt a policy of laissez faire more desperately; never has government seemed more determined to artificially prop up an industry. But only by allowing the housing market to clear can we hope to rebuild our shattered economy from a stable foundation. Clearly there will be pain in the short term, but we owe it to younger Americans and future generations to allow the reemergence of a rational housing market.

linkwithin_text=’Related Articles:’

Be the first to comment on "End Manipulation, Let the Markets Clear!"