|

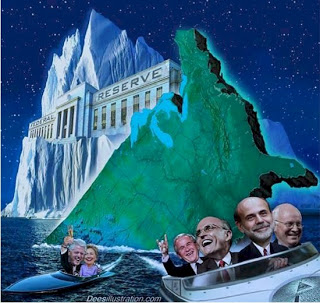

| Dees Illustration |

Greg Hunter

USA Watchdog

In the wake of the financial meltdown of 2008, the Federal Reserve announced it would buy mortgage-backed securities, or MBS. The January announcement by the Fed said it would buy MBS from failed mortgage giants Fannie Mae and Freddie Mac in the amount of $1.25 trillion. At the time, the Fed said in a press release, “The goal of the program was to provide support to mortgage and housing markets and to foster improved conditions in financial markets more generally.” (Click here for the full Fed statement.) It did provide “support” to the mortgage market, but did it also buy fraud and cover the banks that sold it? The evidence shows, at the very least, it bought massive amounts of fraud.

Be the first to comment on "The Fed Bought Fraud"